IHOP 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

95

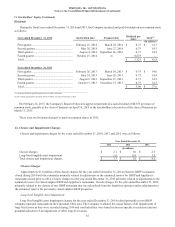

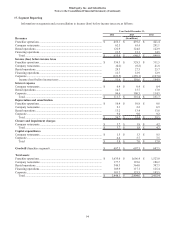

18. Selected Quarterly Financial Data (Unaudited)

Revenues(1) Operating

Margin

Net Income

(Loss)

Net Income

(Loss)

Per Share—

Basic(2)

Net Income

(Loss)

Per Share—

Diluted(2)

(In thousands, except per share amounts)

2014

1st Quarter ................................................ $ 167,201 $ 97,072 $ 20,824 $ 1.09 $ 1.08

2nd Quarter ............................................... 160,521 94,473 19,167 1.00 1.00

3rd Quarter................................................ 162,853 91,629 18,887 0.99 0.99

4th Quarter (1) ................................................. 164,413 91,941 (22,425)(1.18) n/a

2013

1st Quarter ................................................ $ 163,169 $ 94,424 $ 18,239 $ 0.95 $ 0.93

2nd Quarter ............................................... 158,114 91,026 16,937 0.88 0.87

3rd Quarter................................................ 161,283 93,043 18,730 0.98 0.97

4th Quarter................................................ 157,901 91,199 18,131 0.95 0.94

______________________________________________________________________________________________________

(1) Net income was impacted by loss on extinguishment of debt related to the Company's refinancing of its long-term debt. See Note 7 of Notes to

Consolidated Financial Statements.

(2) The quarterly amounts may not add to the full year amount as each quarterly calculation is discrete from the full-year calculation.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

We maintain “disclosure controls and procedures,” as such terms are defined in Rule 13a-15(e) and 15d-15(e) promulgated

under the Exchange Act of 1934, as amended, that are designed to ensure that information required to be disclosed by us in

reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods

specified in SEC rules and forms, and that such information is accumulated and communicated to our management, including

our Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

In designing and evaluating our disclosure controls and procedures, management recognized that disclosure controls and

procedures, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the

objectives of the disclosure controls and procedures are met. Additionally, in designing disclosure controls and procedures, our

management necessarily was required to apply its judgment in evaluating the cost-benefit relationship of possible disclosure

controls and procedures. The design of any disclosure controls and procedures also is based in part upon certain assumptions

about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals

under all potential future conditions.

Based on their assessment as of the end of the period covered by this report, our Chief Executive Officer and Chief

Financial Officer have concluded that our disclosure controls and procedures were effective at the reasonable assurance level.

Management's Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as

defined in Exchange Act Rules 13a-15(f) and 15d-15(f). All internal control systems, no matter how well designed, have

inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with

respect to financial statement preparation and presentation.

Under the supervision and with the participation of our management, including our Chief Executive Officer and Chief

Financial Officer, we conducted an evaluation of the effectiveness of our internal control over financial reporting as of

December 28, 2014 based on the framework in Internal Control—Integrated Framework (2013) issued by the Committee of