IHOP 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

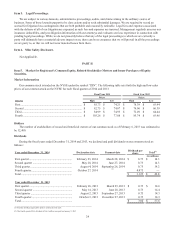

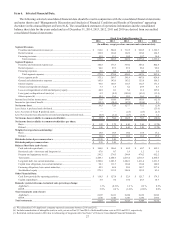

Item 6. Selected Financial Data.

The following selected consolidated financial data should be read in conjunction with the consolidated financial statements

and notes thereto and “Management's Discussion and Analysis of Financial Condition and Results of Operations” appearing

elsewhere in this Annual Report on Form 10-K. The consolidated statement of operations information and the consolidated

balance sheet data for the years ended and as of December 31, 2014, 2013, 2012, 2011 and 2010 are derived from our audited

consolidated financial statements.

Fiscal Year Ended December 31,

2014 2013 2012 2011 2010

(In millions, except per share amounts and restaurant data)

Segment Revenues

Franchise and restaurant revenues (a) .................................................................. $ 518.6 $ 502.6 $ 712.5 $ 929.5 $ 1,192.7

Rental revenues .................................................................................................... 122.9 124.8 122.9 126.0 124.5

Financing revenues............................................................................................... 13.5 13.1 14.5 19.7 16.4

Total revenues................................................................................................. 655.0 640.5 849.9 1,075.2 1,333.6

Segment Expenses

Franchise and restaurant expenses (a) .................................................................. 184.5 173.3 359.2 563.4 802.8

Rental expenses .................................................................................................... 94.6 97.3 97.2 98.2 99.0

Financing expenses............................................................................................... 0.8 0.2 1.6 6.0 2.0

Total segment expenses.................................................................................. 279.9 270.8 458.0 667.6 903.8

Gross segment profit ............................................................................................ 375.1 369.7 391.9 407.6 429.8

General and administrative expenses ................................................................... 145.9 143.6 163.2 155.8 160.3

Interest expense .................................................................................................... 96.6 100.3 114.3 132.7 171.5

Closure and impairment charges .......................................................................... 3.7 1.8 4.2 29.9 4.3

Loss on extinguishment of debt and temporary equity ........................................ 64.9 0.1 5.6 11.2 107.0

Loss (gain) on disposition of assets (a) ................................................................ 0.3 (0.2) (102.6) (43.3) (13.5)

Other expense (b) ................................................................................................. 12.1 13.6 12.3 16.3 12.3

Income (loss) before income taxes............................................................................. 51.6 110.6 194.9 105.0 (12.1)

Income tax (provision) benefit ................................................................................... (15.1) (38.6) (67.2) (29.8) 9.3

Net income (loss)....................................................................................................... 36.5 72.0 127.7 75.2 (2.8)

Less: Series A preferred stock dividends.................................................................... — — — — (25.9)

Less: Accretion of Series B preferred stock............................................................... — — (2.5) (2.6) (2.5)

Less: Net (income) loss allocated to unvested participating restricted stock............. (0.5) (1.2) (2.7) (1.9) 1.2

Net income (loss) available to common stockholders ............................................ $ 35.9 $ 70.8 $ 122.5 $ 70.7 $ (30.0)

Net income (loss) available to common stockholders per share:

Basic ..................................................................................................................... $ 1.92 $ 3.75 $ 6.81 $ 3.96 $ (1.74)

Diluted .................................................................................................................. $ 1.90 $ 3.70 $ 6.63 $ 3.89 $ (1.74)

Weighted average shares outstanding:

Basic ..................................................................................................................... 18.8 18.9 18.0 17.8 17.2

Diluted .................................................................................................................. 19.0 19.1 18.9 18.2 17.2

Dividends declared per common share................................................................... $ 3.125 $ 3.00 $ — $ — $ —

Dividends paid per common share.......................................................................... $ 2.25 $ 3.00 $ — $ — $ —

Balance Sheet Data (end of year):

Cash and cash equivalents.................................................................................... $ 104.0 $ 106.0 $ 64.5 $ 60.7 $ 102.3

Restricted cash—short-term and long-term (c) .................................................... 67.0 0.7 1.9 1.2 1.6

Property and equipment, net (a) ........................................................................... 241.2 274.3 294.4 474.2 612.2

Total assets............................................................................................................ 2,448.1 2,404.6 2,415.4 2,614.3 2,856.6

Long-term debt, less current maturities................................................................ 1,300.0 1,203.5 1,202.1 1,411.4 1,631.5

Capital lease obligations, less current maturities ................................................. 98.1 111.7 124.4 134.4 144.0

Financing obligations, less current maturities...................................................... 42.5 48.8 52.0 162.7 237.8

Stockholders' equity ............................................................................................. 279.1 315.2 308.8 155.2 83.6

Other Financial Data:

Cash flows provided by operating activities ........................................................ $ 118.5 $ 127.8 $ 52.9 $ 121.7 $ 179.3

Capital expenditures ............................................................................................. 5.9 7.0 17.0 26.3 18.7

Domestic system-wide same-restaurant sales percentage change:

Applebee's ............................................................................................................ 1.1% (0.3)% 1.2 % 2.0 % 0.3%

IHOP..................................................................................................................... 3.9% 2.4 % (1.6)% (2.0)% 0.0%

Total restaurants (end of year):

Applebee's ............................................................................................................ 2,017 2,011 2,034 2,019 2,010

IHOP..................................................................................................................... 1,650 1,620 1,581 1,550 1,504

Total restaurants....................................................................................................... 3,667 3,631 3,615 3,569 3,514

_______________________________________________________________________

(a) We refranchised 369 Applebee's company-operated restaurants between 2010 and 2012.

(b) Includes amortization of intangible assets in each year as well as $1.3 and $4.0 of debt modification costs in 2013 and 2011, respectively.

(c) Restricted cash increased in 2014 due to refinancing of long-term debt. See Note 7 of Notes to Consolidated Financial Statements.