IHOP 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

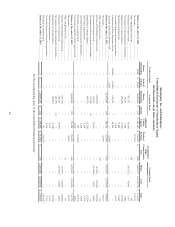

DineEquity, Inc. and Subsidiaries

Consolidated Statements of Stockholders' Equity

(In thousands, except share amounts)

Preferred Stock Common Stock Accumulated

Other

Comprehensive

Loss

Treasury Stock

Shares

Outstanding

Series B

Amount

Shares

Outstanding Amount

Additional

Paid-in

Capital

Retained

Earnings Shares Cost Total

Balance at December 31, 2011............................ 34,900 $ 44,508 18,060,206 $ 247 $ 205,663 $ 196,869 $ (294) 6,598,779 $ (291,773) $ 155,220

Net income ............................................................ — — — — — 127,674 — — — 127,674

Other comprehensive income................................ — — — — — — 142 — — 142

Reissuance of treasury stock ................................. — — 433,732 — (6,636) — — (433,732) 14,089 7,453

Net issuance of shares pursuant to stock plans...... — — 59,622 — 1,800 — — — — 1,800

Repurchase of restricted shares ............................. — — (34,829) — (1,740) — — — — (1,740)

Stock-based compensation .................................... — — — — 11,442 — — — — 11,442

Tax benefit from stock-based compensation......... — — — — 6,814 — — — — 6,814

Conversion of Series B preferred stock................. (34,900) (47,006) 679,168 7 46,999 — — — — —

Accretion of Series B preferred stock ................... — 2,498 — — — (2,498) — — — —

Balance at December 31, 2012............................ — — 19,197,899 254 264,342 322,045 (152) 6,165,047 (277,684) 308,805

Net income ............................................................ — — — — — 72,037 — — — 72,037

Other comprehensive loss ..................................... — — — — — — (12) — — (12)

Purchase of DineEquity common stock ................ — — (412,022) — — — — 412,022 (29,698)(29,698)

Reissuance of treasury stock ................................. — — 318,644 — (2,612) — — (318,644) 11,692 9,080

Net issuance of shares pursuant to stock plans...... — — (17,659) (1) — — — — — (1)

Repurchase of restricted shares ............................. — — (45,972) — (3,324) — — — — (3,324)

Stock-based compensation .................................... — — — — 9,364 — — — — 9,364

Tax benefit from stock-based compensation......... — — — — 3,690 — — — — 3,690

Dividends on common stock ................................. — — — — 139 (57,504) — — — (57,365)

Conversion of liability award to equity award ...... — — — — 2,603 — — — — 2,603

Balance at December 31, 2013............................ — — 19,040,890 253 274,202 336,578 (164) 6,258,425 (295,690) 315,179

Net income ............................................................ — — — — — 36,453 — — — 36,453

Other comprehensive loss ..................................... — — — — — — 91 — — 91

Purchase of DineEquity common stock ................ — — (387,591) — — — — 387,591 (32,006)(32,006)

Reissuance of treasury stock ................................. — — 359,528 — (4,793) — — (359,528) 13,000 8,207

Net issuance of shares pursuant to stock plans...... — — (20,767) (1) 1 — — — — —

Repurchase of restricted shares ............................. — — (38,493) (3,194) — — — — (3,194)

Stock-based compensation .................................... — — — — 9,319 — — — — 9,319

Tax benefit from stock-based compensation......... — — — — 4,316 — — — — 4,316

Dividends on common stock ................................. — — — — 95 (59,387) — — — (59,292)

Balance at December 31, 2014............................ — $ — 18,953,567 $ 252 $ 279,946 $ 313,644 $ (73) 6,286,488 $ (314,696) $ 279,073

See the accompanying notes to the consolidated financial statements.