IHOP 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

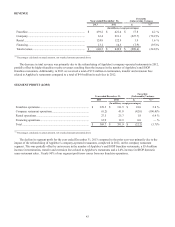

Closure and Impairment Charges

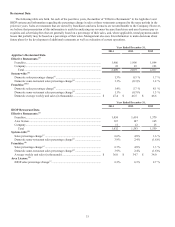

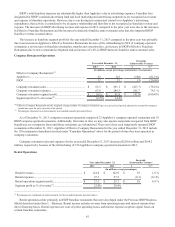

Closure and impairment charges for the years ended December 31, 2014 and 2013 were as follows:

Year Ended

December 31,

2014 2013

(In millions)

Closure charges.................................................................................................................. $ 2.1 $ 1.0

Long-lived tangible asset impairment................................................................................ 1.6 0.8

Total closure and impairment charges............................................................................... $ 3.7 $ 1.8

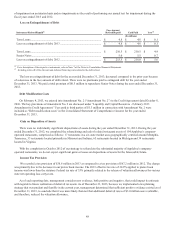

Approximately $1.0 million of the closure charges for the year ended December 31, 2014 related to IHOP restaurants

closed during 2014 with the remainder primarily related to adjustments to the estimated reserve for IHOP and Applebee's

restaurants closed prior to 2014. Closure charges for the year ended December 31, 2013 primarily related to adjustments to the

estimated reserve for closed IHOP and Applebee's restaurants.

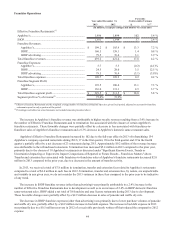

On a regular basis, we assess whether events or changes in circumstances have occurred that potentially indicate the

carrying value of tangible long-lived assets, primarily assets related to company-operated restaurants, may not be recoverable.

Recoverability of a restaurant's assets is measured by comparing the assets' carrying value to the undiscounted future cash

flows expected to be generated over the assets' remaining useful lives or remaining lease terms, whichever is less. If the total

expected undiscounted future cash flows are less than the carrying amount of the assets, this may be an indicator of

impairment. If it is decided that there has been an impairment, the carrying amount of the asset is written down to the estimated

fair value. The fair value is primarily determined based on a discounted cash flow analysis.

Long-lived tangible asset impairment charges for the year ended December 31, 2014 related to two IHOP company-

operated restaurants in the Cincinnati, Ohio area. Long-lived tangible asset impairment charges for the year ended

December 31, 2013 related to three Applebee's company-operated restaurants in the Kansas City, Missouri area. In each year

we evaluated the causal factors of all impairments of long-lived assets as they were recorded and concluded the impairments

were based on factors specific to each asset and were not potential indicators of an impairment of other long-lived assets.

See “Critical Accounting Policies and Estimates - Goodwill and Intangibles” for a description of our policy with respect to

the review for impairments of goodwill and indefinite life intangible assets. In carrying out that policy, we noted no indicators

of impairment on an interim basis and no impairments as the result of performing our annual test for impairment during the

fiscal years ended 2014 and 2013.

Debt Modification Costs

On February 4, 2013, we entered into Amendment No. 2 (“Amendment No. 2”) to the Credit Agreement dated October 8,

2010. Fees paid to third parties of $1.3 million in connection with Amendment No. 2 were included as “Debt modification

costs” in the Consolidated Statement of Comprehensive Income for the year ended December 31, 2013.

Gain on Disposition of Assets

There were no individually significant dispositions of assets during the years ended December 31, 2014 and 2013.

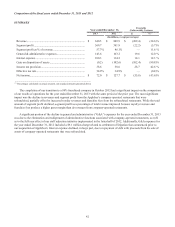

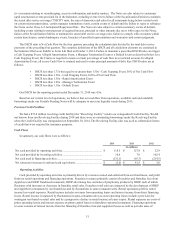

Income Tax Provision

We recorded a tax provision of $15.1 million in 2014 as compared to a tax provision of $38.6 million in 2013. The change

was primarily due to the decrease in our pretax book income. The 2014 effective tax rate of 29.3% applied to pretax book

income was lower than the statutory Federal tax rate of 35% primarily due to the Company’s retroactive adoption in 2014 of the

domestic production activity deduction and the federal research and experimentation credit. Our 2014 effective tax rate was

reduced by 6.6% because of domestic production activity deductions and research and experimentation credits generated from

tax years prior to 2014.

As of each reporting date, we consider new evidence, both positive and negative, that could impact our view with regards

to future realization of deferred tax assets. As of December 31, 2014, we determined that, based on available evidence, no

change to the valuation allowance against deferred tax assets was warranted.