IHOP 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

67

(11 Applebee's franchisees and four IHOP franchisees). These franchisees operated 1,693 Applebee's and IHOP restaurants in

the United States, which comprised 49% of the total Applebee's and IHOP franchise and area license restaurants in the United

States. Receivables from these franchisees totaled $50.7 million at December 31, 2014.

The Company maintains an allowance for credit losses based upon historical experience while taking into account current

economic conditions.

Cash and Cash Equivalents

The Company considers all highly liquid investment securities with remaining maturities at the date of purchase of three

months or less to be cash equivalents. These cash equivalents are stated at cost which approximates market value. Cash held

related to IHOP advertising funds and the Company's gift card programs are classified as unrestricted cash as there are no legal

restrictions on the use of these funds. Total cash balances related to the IHOP advertising funds and the Company's gift card

programs were $56.2 million and $53.2 million as of December 31, 2014 and 2013, respectively.

Restricted Assets

Restricted Cash - Current

Current restricted cash of $52.3 million as of December 31, 2014 consisted of $52.1 million of funds required to be held in

trust in connection with the Company's securitized debt arrangements and $0.2 million of funds from Applebee's franchisees

pursuant to franchise agreements, usage of which is restricted to advertising activities. Current restricted cash of $0.7 million at

December 31, 2013 related to funds from Applebee's franchisees pursuant to franchise agreements, usage of which is restricted

to advertising activities.

Restricted Cash - Non-current

Non-current restricted cash of $14.7 million as of December 31, 2014 represents interest reserves required to be set aside

for the duration of the securitized debt and is included in other non-current assets, net in the consolidated balance sheets.

Other Restricted Assets

At December 31, 2014 and 2013, restricted assets related to a captive insurance subsidiary totaled $1.2 million and $1.9

million, respectively, and were included in other non-current assets, net in the consolidated balance sheets. The captive

insurance subsidiary, which has not underwritten coverage since January 2006, was formed to provide insurance coverage to

Applebee's and its franchisees. These restricted assets are primarily investments, use of which is restricted to the payment of

insurance claims for incidents that occurred during the period the insurance coverage had been provided.

Investments

The Company's investments comprise certificates of deposit, money market funds and an auction rate security that are the

restricted assets related to the captive insurance subsidiary. The Company has classified all investments as available-for-sale

with any unrealized gain or loss included in Accumulated Other Comprehensive Loss. The contractual maturity of the auction

rate security is 2030.

Property and Equipment

Property and equipment are stated at cost, net of accumulated depreciation. Properties under capital leases are stated at the

present value of the minimum lease payments. Depreciation is computed using the straight-line method over the estimated

useful lives of the assets or remaining useful lives. Leasehold improvements and properties under capital leases are amortized

on a straight-line basis over their estimated useful lives or the lease term, if less. The Company has capitalized certain costs

incurred in connection with the development of internal-use software which are included in equipment and fixtures and

amortized over the expected useful life of the asset. The general ranges of depreciable and amortizable lives are as follows:

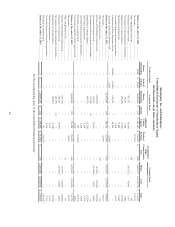

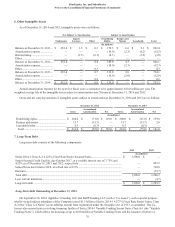

Category Depreciable Life

Buildings and improvements...................... 25 - 40 years

Leaseholds and improvements ................... Shorter of primary lease term or between three to 40 years

Equipment and fixtures .............................. Two to 10 years

Properties under capital leases ................... Primary lease term or remaining primary lease term