IHOP 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

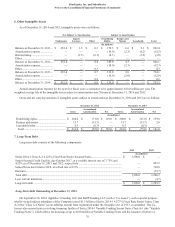

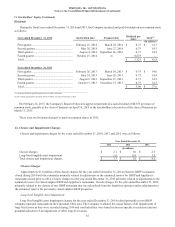

7. Long-Term Debt (Continued)

81

obligations of the Company and were jointly and severally guaranteed on a senior unsecured basis by the Guarantors under the

Credit Agreement. The Senior Notes were repaid on October 30, 2014. See “2014 Refinancing of Long-term Debt.”

Prepayment

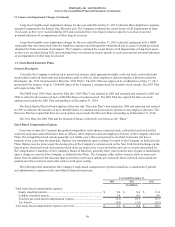

The Company could redeem the Senior Notes for cash in whole or in part, at any time or from time to time, on and after

October 30, 2014, at specified redemption premiums, plus accrued and unpaid interest, as specified in the Indenture. In

addition, prior to October 30, 2014, the Company could redeem the Senior Notes for cash in whole or in part, at any time and

from time to time, at a redemption price equal to 100% of the principal amount plus accrued and unpaid interest and a “make-

whole” premium, as specified in the Indenture. The make-whole payment was $36.1 million as of October 30, 2014.

In addition, prior to October 30, 2013, the Company could redeem up to 35% of the aggregate principal amount of Senior

Notes issued with the net proceeds raised in one or more equity offerings. If the Company underwent a change of control under

certain circumstances, the Company could have been required to offer to purchase the Senior Notes at a purchase price equal to

101% of the principal amount plus accrued and unpaid interest. If the Company sells assets under certain circumstances, the

Company could have been required to offer to purchase the Senior Notes at a purchase price equal to 100% of the principal

amount plus accrued and unpaid interest.

Covenants/Restrictions

The Senior Note Indenture limited the ability of the Company and its restricted subsidiaries to incur additional

indebtedness (excluding certain indebtedness under the Credit Facility), issue certain preferred shares, pay dividends and make

other equity distributions, purchase or redeem capital stock, make certain investments, create certain liens on its assets to secure

certain debt, enter into certain transactions with affiliates, agree to any restrictions on the ability of the Company's restricted

subsidiaries to make payments to the Company, merge or consolidate with another company, transfer and sell assets, engage in

business other than certain permitted businesses and designate its subsidiaries as unrestricted subsidiaries, in each case as set

forth in the Senior Note Indenture. These covenants were subject to a number of important limitations, qualifications and

exceptions, including that during any time that the Notes maintain investment grade ratings, certain of these covenants will not

be applicable to the Notes.

The Senior Note Indenture also contained customary event of default provisions including, among others, the following:

default in the payment of the principal of the Notes when the same becomes due and payable; default for 30 days in the

payment when due of interest on the Notes; failure to comply with certain covenants in the Indenture, in some cases without

notice from the Trustee or the holders of Notes; and certain events of bankruptcy or insolvency with respect to the Company or

any significant restricted subsidiary, in each case as set forth in the Senior Note Indenture. In the case of an event of default,

other than a bankruptcy default with respect to the Company, the Trustee or the holders of at least 25% in aggregate principal

amount of the Notes then outstanding, by written notice to the Company (and to the Trustee if the notice is given by the holders

of the Notes), could, and the Trustee at the written request of the holders of at least 25% in aggregate principal amount of the

Notes then outstanding would, declare the principal of and accrued interest on the Notes to be immediately due and payable.

Restricted Payments

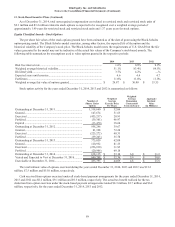

The Credit Agreement contained covenants considered customary for similar types of facilities that limit certain permitted

restricted payments, including those related to dividends on and repurchases of our common stock. Such restricted payments

were limited to a cumulative amount comprised of (i) a general restricted payments allowance of $35.0 million, plus (ii) 50% of

Excess Cash Flow for each fiscal quarter in which the consolidated leverage ratio is greater than 5.75:1; (iii) 75% of Excess

Cash Flow for each fiscal quarter if the consolidated leverage ratio is less than 5.75:1 and greater than or equal to 5.25:1; (iv)

100% of Excess Cash Flow for each fiscal quarter in which the consolidated leverage ratio is less than 5.25:1; and (v) proceeds

from the exercise of options to purchase our common stock, less any amounts paid as dividends or to repurchase our common

stock.

The Senior Note Indenture also contained a limitation on restricted payments that is calculated on an annual basis. Such

restricted payments were limited to a cumulative amount comprised of (i) 50% of consolidated net income (as defined in the

Indenture), plus (ii) proceeds from exercise of stock options, less (iii) restricted payments made.