IHOP 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

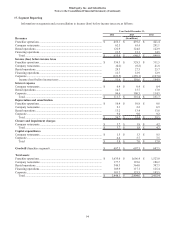

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

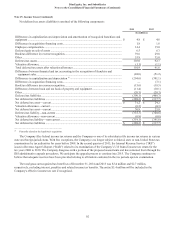

10. Commitments and Contingencies (Continued)

85

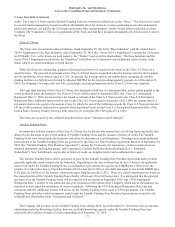

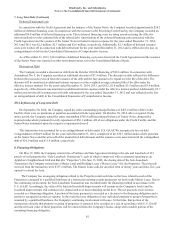

Lease Guarantees

In connection with the sale of Applebee's restaurants to franchisees and other parties, the Company has, in certain cases,

guaranteed or had potential continuing liability for lease payments. As of December 31, 2014 and 2013, the Company has

outstanding lease guarantees or is contingently liable for approximately $378.1 million and $417.8 million, respectively. This

amount represents the maximum potential liability of future payments under these leases. These leases have been assigned to

the buyers and expire at the end of the respective lease terms, which range from 2014 through 2048. In the event of default, the

indemnity and default clauses in our sale or assignment agreements govern our ability to pursue and recover damages incurred.

No material liabilities have been recorded as of December 31, 2014.

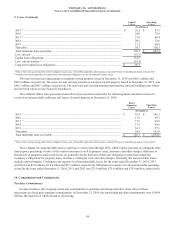

Litigation, Claims and Disputes

The Company is subject to various lawsuits, governmental inspections, administrative proceedings, audits, and claims

arising in the ordinary course of business. Some of these lawsuits purport to be class actions and/or seek substantial damages.

The Company is required to record an accrual for litigation loss contingencies that are both probable and reasonably estimable.

Legal fees and expenses associated with the defense of all of the Company's litigation are expensed as such fees and expenses

are incurred. In the opinion of management, these matters are adequately covered by insurance or, if not so covered, are without

merit or are of such a nature or involve amounts that would not have a material adverse impact on the Company's business or

consolidated financial statements. Management regularly assesses the Company's insurance deductibles, analyzes litigation

information with the Company's attorneys and evaluates its loss experience in connection with pending legal proceedings.

While the Company does not presently believe that any of the legal proceedings to which the Company is currently a party will

ultimately have a material adverse impact on the Company, there can be no assurance that the Company will prevail in all the

proceedings the Company is party to, or that the Company will not incur material losses from them.

Letters of Credit

The Company provides letters of credit, primarily to various insurance carriers to collateralize obligations for outstanding

claims. As of December 31, 2014, the Company had approximately $9.6 million of unused letters of credit outstanding. These

letters expire on various dates in 2015 and are automatically renewed for an additional year if no cancellation notice is

submitted.

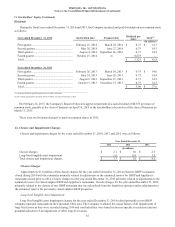

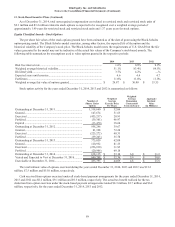

11. Stockholders' Equity

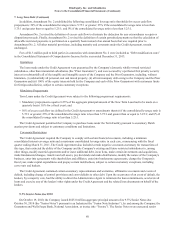

Preferred Stock

Series B Convertible Preferred Stock

On November 29, 2007, the Company issued and sold 35,000 shares of Series B Convertible Preferred Stock for an

aggregate purchase price of $35.0 million in cash. Total issuance costs were approximately $0.8 million. All of the shares were

sold to affiliates of Chilton Investment Company, LLC (collectively, “Chilton”) pursuant to a purchase agreement dated as of

July 15, 2007. The shares of Series B Convertible Preferred Stock ranked (i) senior to the common stock, and any series of

preferred stock specifically designated as junior to the Series B Convertible Preferred Stock, with respect to the payment of

dividends and distributions, in a liquidation, dissolution or winding up, and upon any other distribution of the Company's

assets; and (ii) on a parity with all other series of preferred stock, with respect to the payment of dividends and distributions, in

a liquidation, dissolution or winding up, and upon any other distribution of the Company's assets.

Each share of Series B Convertible Preferred Stock had an initial stated value of $1,000, that increased at the rate of 6.0%

per annum, compounded quarterly, commencing on the issue date of such share of Series B Convertible Preferred Stock to and

including the earlier of (i) the date of liquidation, dissolution or winding up or the redemption of such share, or (ii) the date such

share is converted into the Company's common stock. The stated value of a share as so accreted as of any date was referred to

as the accreted value of the share as of that date. The Series B Convertible Preferred Stock entitled the holders thereof to

receive certain dividends and distributions to the extent that any dividends or distributions paid on the Company's common

stock exceeded the annual accretion on the Series B Convertible Preferred Stock. Holders of Series B Convertible Preferred

Stock were entitled to vote on all matters (including the election of directors) submitted to the holders of the Company's

common stock, as a single class with the holders of the Company's common stock, with each share of Series B Convertible

Preferred Stock having one vote per share of the Company's common stock then issuable upon conversion of such share of

Series B Convertible Preferred Stock.

At any time and from time to time, any holder of Series B Convertible Preferred Stock could convert all or any portion of

the Series B Convertible Stock held by such holder into a number of shares of the Company's common stock computed by