Holiday Inn 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

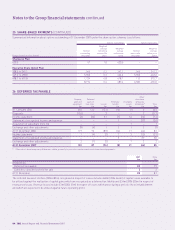

7 SHARE CAPITAL

Number of shares

Note millions £m

Authorised (ordinary shares)

At 31 December 2006 (1,400,000,000 shares of 11 3⁄7p each) 1,400 160

Share capital consolidation a(225) –

At 31 December 2007 (1,175,000,000 shares of 13 29⁄47p each) 1,175 160

Authorised (preference shares)

One redeemable preference share (£50,000) – –

Allotted, called up and fully paid (ordinary shares)

At 31 December 2006 (11 3⁄7p each) 356 41

Share capital consolidation a(57) –

Issued under option schemes 4–

Repurchase of shares b(8) (1)

At 31 December 2007 (13 29⁄47p each) 295 40

a On 1 June 2007, shareholders approved a share capital consolidation on the basis of 47 new ordinary shares for every 56 existing ordinary shares. This provided

for all the authorised ordinary shares of 11 3⁄7p each (whether issued or unissued) to be consolidated into new ordinary shares of 13 29⁄47p each. The share

capital consolidation became effective on 4 June 2007.

b During the year, 7,724,844 (2006 28,409,753) ordinary shares were repurchased and cancelled under the authorities granted by shareholders at an Extraordinary

General Meeting held on 1 June 2006 and at the Annual and Extraordinary General Meetings held on 1 June 2007. Of these, 2,237,264 were 11 3⁄7p shares and

5,487,580 were 13 29⁄47p shares.

The aggregate consideration in respect of ordinary shares issued under option schemes during the year was £16m (2006 £20m).

Thousands

Options to subscribe for ordinary shares

At 31 December 2006 14,244

Exercised (5,669)

Lapsed or cancelled (324)

At 31 December 2007 8,251

Option exercise price per ordinary share (pence) 308.5-619.8

Final exercise date 4 April 2015

The authority given to the Company at the Annual General Meeting on 1 June 2007 to purchase its own shares was still valid at

31 December 2007. A resolution to renew the authority will be put to shareholders at the Annual General Meeting on 30 May 2008.

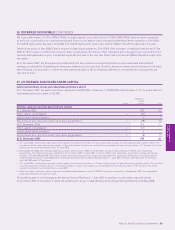

8 MOVEMENTS IN RESERVES

Share Capital Profit and

premium account redemption reserve loss account

£m £m £m

At 31 December 2006 25 4 1,000

Premium on allotment of ordinary shares 16 – –

Repurchase of shares – – (80)

Transfer to capital redemption reserve – 1 (1)

Profit after tax – – 111

Dividends – – (773)

At 31 December 2007 41 5 257

9 PROFIT AND DIVIDENDS

Profit on ordinary activities after tax amounts to £111m (2006 £53m).

A final dividend, declared in the previous year, of 13.3p (2006 10.7p) per share was paid during the year, amounting to £47m (2006 £46m).

A special interim dividend of 200.0p (2006 118.0p) per share was paid during the year, amounting to £709m (2006 £497m). An interim

dividend of 5.7p (2006 5.1p) per share was paid during the year, amounting to £17m (2006 £18m). A final dividend of 14.9p (2006 13.3p)

per share, amounting to £44m (2006 £47m), is proposed for approval at the Annual General Meeting. The proposed final dividend is

payable on shares in issue at 28 March 2008.

The audit fee for both years was borne by a subsidiary undertaking.

10 CONTINGENCIES

Contingent liabilities of £840m (2006 £169m) in respect of guarantees of the liabilities of subsidiaries have not been provided for in the

financial statements.

94 IHG Annual Report and Financial Statements 2007

Notes to the parent company financial statements continued