Holiday Inn 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 IHG Annual Report and Financial Statements 2007

Business review continued

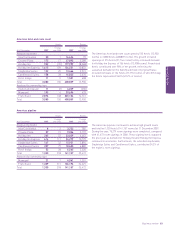

12 months ended 31 December

2007 2006 %

£m £m change

Revenue

Americas 450 422 6.6

EMEA 245 198 23.7

Asia Pacific 130 111 17.1

Central 58 55 5.5

Continuing operations 883 786 12.3

Discontinued operations 40 174 (77.0)

923 960 (3.9)

Operating profit

Americas 220 215 2.3

EMEA 67 37 81.1

Asia Pacific 31 29 6.9

Central (81) (81) –

Continuing operations 237 200 18.5

Discontinued operations 831 (74.2)

Operating profit before

exceptional items 245 231 6.1

Exceptional operating items 30 27 11.1

Operating profit 275 258 6.6

Net financial expenses (45) (11) (309.1)

Profit before tax* 230 247 (6.9)

Analysed as:

Continuing operations 222 216 2.8

Discontinued operations 831 (74.2)

Earnings per ordinary share

Basic 72.2p 104.1p (30.6)

Adjusted 48.4p 42.9p 12.8

Adjusted – continuing operations 46.9p 38.0p 23.4

* Profit before tax includes the results of discontinued operations.

Revenue from continuing operations increased by 12.3% to

£883m and continuing operating profit increased by 18.5% to

£237m during the 12 months ended 31 December 2007. The

growth was driven by strong underlying RevPAR gains across

all regions, hotel expansion in key markets and profit uplift

from owned and leased assets. Furthermore, strong revenue

conversion led to a 1.4 percentage point increase in continuing

operating profit margins to 26.8%.

Including discontinued operations, total revenue decreased by

3.9% to £923m whilst operating profit before exceptional items

increased by 6.1% to £245m, reflecting the year-on-year impact

of asset disposals. Discontinued operations represent the results

from operations that have been sold, or are held for sale, and

where there is a coordinated plan to dispose of the operations

under IHG’s asset disposal programme. In this Business Review,

discontinued operations include owned and leased hotels in the

US, the UK and Continental Europe that have been sold or placed

on the market from 1 January 2006.

As the weighted average US dollar exchange rate to sterling has

weakened during 2007 (2007 $2.01:£1, 2006 $1.84:£1), growth

rates for results expressed in US dollars are higher than those

in sterling. Continuing operating profit before exceptional items

was $474m, ahead of 2006 by 29.2%. Including discontinued

operations, operating profit before exceptional items was

$491m, 15.8% higher than 2006. Translated at constant currency,

applying 2006 exchange rates, continuing revenue increased

by 19.6% and continuing operating profit increased by 30.0%.

One measure of overall IHG hotel system performance is the

growth in total gross revenue, defined as total room revenue from

franchised hotels and total hotel revenue from managed, owned

and leased hotels. Total gross revenue is not revenue attributable

to IHG, as it is derived mainly from hotels owned by third parties.

Total gross revenue increased by 17.1% from $15.2bn in 2006

to $17.8bn in 2007, with strong growth levels achieved across

IHG’s key brands reflecting hotel performance and room growth.

Translated at constant currency, total gross revenue increased

by 14.5%.

Group performance

Group results

Total gross revenues

12 months ended 31 December

2007 2006 %

$bn $bn change

InterContinental 3.7 3.0 23.3

Crowne Plaza 2.8 2.3 21.7

Holiday Inn 6.7 6.3 6.3

Holiday Inn Express 3.5 3.0 16.7

Other brands 1.1 0.6 83.3

Total 17.8 15.2 17.1