Holiday Inn 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP FINANCIAL

STATEMENTS

Notes to the Group financial statements 71

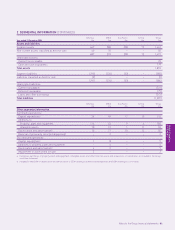

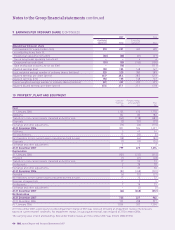

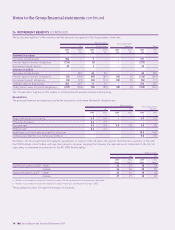

15 OTHER FINANCIAL ASSETS (CONTINUED)

The movement in the provision for impairment of other financial assets during the year is as follows:

2007 2006

£m £m

At 1 January (21) (16)

Provided and charged to gain on disposal of assets –(10)

Recoveries 23

Disposals 3–

Amounts written off against the financial asset 12 1

Exchange and other adjustments –1

At 31 December (4) (21)

The provision is used to record impairment losses unless the Group is satisfied that no recovery of the amount is possible; at that point

the amount considered irrecoverable is written off against the financial asset directly with no impact on the income statement.

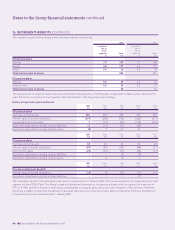

16 INVENTORIES

2007 2006

£m £m

Finished goods 11

Consumable stores 22

33

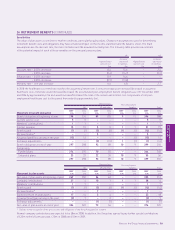

17 TRADE AND OTHER RECEIVABLES

2007 2006

£m £m

Trade receivables 180 163

Other receivables 29 51

Prepayments 26 23

235 237

Trade and other receivables are designated as ‘loans and receivables’ and are held at amortised cost.

Trade receivables are non-interest bearing and are generally on payment terms of up to 30 days. The fair value of trade and other

receivables approximates their carrying value.

The maximum exposure to credit risk for trade and other receivables, excluding prepayments, at the balance sheet date by geographic region is:

2007 2006

£m £m

Americas 115 105

Europe, Middle East and Africa 70 78

Asia Pacific 24 31

209 214

The aging of trade and other receivables, excluding prepayments, at the balance sheet date is:

2007 2006

Gross Provision Net Gross Provision Net

£m £m £m £m £m £m

Not past due 141 (1) 140 118 – 118

Past due 1 to 30 days 37 (1) 36 62 (1) 61

Past due 31 to 180 days 39 (8) 31 49 (16) 33

More than 180 days 40 (38) 2 28 (26) 2

257 (48) 209 257 (43) 214

GROUP FINANCIAL

STATEMENTS