Holiday Inn 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 IHG Annual Report and Financial Statements 2007

Corporate information and accounting policies

Corporate information

The consolidated financial statements of InterContinental Hotels

Group PLC (the Group or IHG) for the year ended 31 December

2007 were authorised for issue in accordance with a resolution of

the Directors on 18 February 2008. InterContinental Hotels Group

PLC (the Company) is incorporated in Great Britain and registered

in England and Wales.

Summary of significant accounting policies

Basis of preparation

The consolidated financial statements are presented in sterling

and all values are rounded to the nearest million (£m) except

where otherwise indicated.

Statement of compliance

The consolidated financial statements of IHG have been prepared

in accordance with International Financial Reporting Standards

(IFRS) as adopted by the European Union and as applied in

accordance with the provisions of the Companies Act 1985.

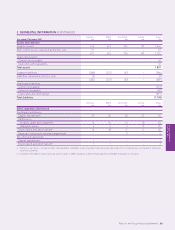

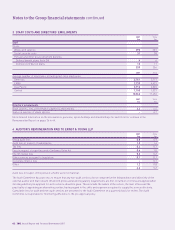

The Group has early adopted International Financial Reporting

Interpretations Committee 14 ‘IAS 19 – The Limit on a Defined

Benefit Asset, Minimum Funding Requirements and their

Interaction’ (IFRIC 14). IFRIC 14 provides guidance on assessing

the limit in International Accounting Standard 19 ‘Employee

Benefits’ (IAS 19) on the amount of the surplus that can be

recognised as an asset. It also explains how the pension asset

or liability may be affected by a statutory or contractual minimum

funding requirement. Under IFRIC 14, the Group has recognised

retirement benefit assets of £32m on the balance sheet at

31 December 2007.

The Group has also adopted International Financial Reporting

Standard 7 ‘Financial Instruments: Disclosures’ (IFRS 7) for

the first time in these financial statements. This is a disclosure

standard only which has had no impact on the Group’s results

or net assets. The new disclosures are included throughout

the financial statements.

Other new accounting standards and interpretations issued

by the International Accounting Standards Board (IASB) and the

International Financial Reporting Interpretations Committee

(IFRIC), becoming effective during the year, have not had a

material impact on the Group’s financial statements.

The principal accounting policies of the Group are set out below.

Basis of consolidation

The Group financial statements comprise the financial statements

of the parent company and entities controlled by the Company. All

inter-company balances and transactions have been eliminated.

The results of those businesses acquired or disposed of are

consolidated for the period during which they were under the

Group’s control.

Foreign currencies

Transactions in foreign currencies are translated to the

functional currency at the exchange rates ruling on the dates of

the transactions. Monetary assets and liabilities denominated

in foreign currencies are retranslated to the functional currency

at the relevant rates of exchange ruling at the balance sheet

date. All foreign exchange differences arising on translation are

recognised in the income statement except on foreign currency

borrowings that provide a hedge against a net investment in

a foreign operation. These are taken directly to the currency

translation reserve until the disposal of the net investment, at

which time they are recycled against the gain or loss on disposal.

The assets and liabilities of foreign operations, including goodwill,

are translated into sterling at the relevant rates of exchange ruling

at the balance sheet date. The revenues and expenses of foreign

operations are translated into sterling at weighted average rates

of exchange for the period. The exchange differences arising on

the retranslation are taken directly to the currency translation

reserve. On disposal of a foreign operation, the cumulative

amount recognised in the currency translation reserve relating

to that particular foreign operation is recycled against the gain

or loss on disposal.

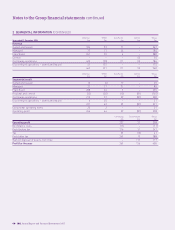

Derivative financial instruments and hedging

Derivatives designated as hedging instruments are accounted

for in line with the nature of the hedging arrangement. The

Group’s detailed accounting policies with respect to hedging

instruments are set out in note 21. Documentation outlining the

measurement and effectiveness of the hedging arrangement is

maintained throughout the life of the hedge relationship. Any

ineffective element of a hedge arrangement is recognised in

financial income or expense.

Interest arising from currency swap agreements is taken to

financial income or expense on a gross basis over the term of

the relevant agreements. Interest arising from other currency

derivatives and interest rate swaps is taken to financial income

or expense on a net basis over the term of the agreement.

Foreign exchange gains and losses on currency instruments are

recognised in financial income and expense unless they form

part of effective hedge relationships.

The fair value of derivatives is calculated by discounting the

expected future cash flows at prevailing interest rates.

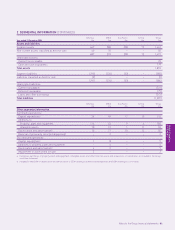

Property, plant and equipment

Property, plant and equipment are stated at cost less depreciation

and any impairment.

Borrowing costs are not capitalised. Repairs and maintenance

costs are expensed as incurred.

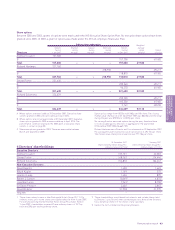

Land is not depreciated. All other property, plant and equipment

are depreciated to a residual value over their estimated useful

lives, namely:

buildings – lesser of 50 years and unexpired term of lease; and

fixtures, fittings and equipment – 3 to 25 years.

All depreciation is charged on a straight-line basis. Residual value

is reassessed annually.