Holiday Inn 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 IHG Annual Report and Financial Statements 2007

Notes to the Group financial statements continued

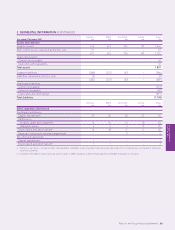

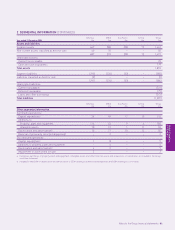

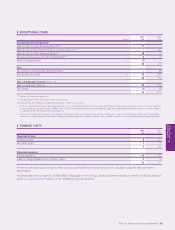

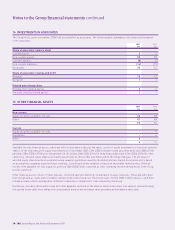

9 EARNINGS PER ORDINARY SHARE (CONTINUED)

2007 2006

Continuing Continuing

operations Total operations Total

Adjusted earnings per share

Profit available for equity holders (£m) 210 231 269 405

Less adjusting items (note 5):

Exceptional operating items (£m) (30) (30) (27) (27)

Tax on exceptional operating items (£m) ––66

Exceptional tax credit (£m) (30) (30) (100) (100)

Gain on disposal of assets, net of tax (£m) – (16) – (117)

Adjusted earnings (£m) 150 155 148 167

Basic weighted average number of ordinary shares (millions) 320 320 389 389

Adjusted earnings per share (pence) 46.9 48.4 38.0 42.9

Adjusted earnings (£m) 150 155 148 167

Diluted weighted average number of ordinary shares (millions) 329 329 399 399

Adjusted diluted earnings per share (pence) 45.6 47.1 37.1 41.8

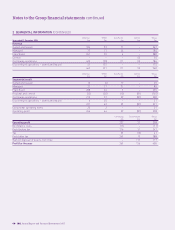

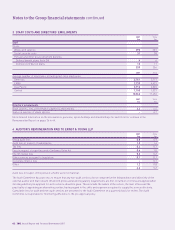

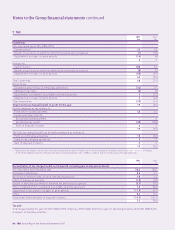

10 PROPERTY, PLANT AND EQUIPMENT

Land and Fixtures, fittings

buildings and equipment Total

£m £m £m

Cost

At 1 January 2006 1,155 615 1,770

Additions 104 82 186

Transfers to non-current assets classified as held for sale (363) (118) (481)

Disposals (2) (31) (33)

Exchange and other adjustments (73) (42) (115)

At 31 December 2006 821 506 1,327

Additions 54954

Reclassifications 15 (20) (5)

Net transfers to non-current assets classified as held for sale (38) (44) (82)

Disposals (7) (19) (26)

Exchange and other adjustments 3 3 6

At 31 December 2007 799 475 1,274

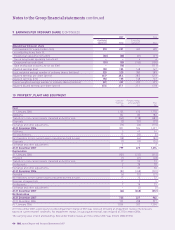

Depreciation

At 1 January 2006 (101) (313) (414)

Provided (7) (41) (48)

Transfers to non-current assets classified as held for sale 17 55 72

On disposals 22830

Exchange and other adjustments 7 23 30

At 31 December 2006 (82) (248) (330)

Provided (6) (33) (39)

Net transfers to non-current assets classified as held for sale 17 15 32

Reversal of impairment –33

On disposals 71825

Exchange and other adjustments – (3) (3)

At 31 December 2007 (64) (248) (312)

Net book value

At 31 December 2007 735 227 962

At 31 December 2006 739 258 997

At 1 January 2006 1,054 302 1,356

At 31 December 2007, a previously recorded impairment charge of £3m was reversed following an impairment review of hotel assets

based on current market conditions. No impairment charge, or subsequent reversal, was required at 31 December 2006.

The carrying value of land and buildings held under finance leases at 31 December 2007 was £104m (2006 £93m).