Holiday Inn 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 IHG Annual Report and Financial Statements 2007

Business review continued

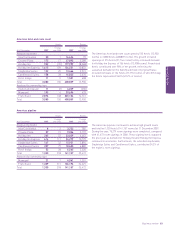

12 months ended 31 December

2007 2006 %

$m $m change

Revenue

Owned and leased 257 192 33.9

Managed 156 143 9.1

Franchised 489 443 10.4

Continuing operations 902 778 15.9

Discontinued operations* 62 74 (16.2)

Total $m 964 852 13.1

Sterling equivalent £m 481 463 3.9

Operating profit before exceptional items

Owned and leased 40 22 81.8

Managed 41 50 (18.0)

Franchised 425 382 11.3

506 454 11.5

Regional overheads (66) (59) (11.9)

Continuing operations 440 395 11.4

Discontinued operations* 16 12 33.3

Total $m 456 407 12.0

Sterling equivalent £m 228 221 3.2

* Discontinued operations are all owned and leased.

Revenue and operating profit from continuing operations

increased by 15.9% to $902m and 11.4% to $440m respectively.

Discontinued operations include the results of hotels sold during

2006 and 2007, together with two hotels currently on the market

for disposal. Including discontinued operations, revenue increased

by 13.1% whilst operating profit increased by 12.0%.

The region achieved healthy RevPAR growth across all ownership

types and RevPAR premiums to the US market segments for hotels

operating under InterContinental, Crowne Plaza, Holiday Inn and

Holiday Inn Express brands. During the fourth quarter, consistent

with the US market, the region was impacted by a marginal softening

in RevPAR growth due to a slight decline in occupancy levels.

Continuing owned and leased revenue increased by 33.9% to

$257m and operating profit increased by 81.8% to $40m. Positive

underlying trading was driven by RevPAR growth of 9.7%, led by

the InterContinental brand with growth of 10.6%. The results were

favourably impacted by trading performance at the InterContinental

Boston which became fully operational during the first half of the

year (year-on-year profit increase of $11m) and trading at the

InterContinental New York where robust market conditions lifted

average occupancy levels to over 90%.

Managed revenues increased by 9.1% to $156m during the year,

driven by strong RevPAR growth, particularly in Latin America where

rate-led RevPAR growth exceeded 20%. Robust brand performance

resulted in RevPAR growth premiums, compared to respective

US market segments, for InterContinental, Crowne Plaza and

Holiday Inn. Growth in the extended stay segment was impacted

by an increase in market supply. Managed revenues included

$86m (2006 $80m) from properties that are structured, for legal

reasons, as operating leases but with the same characteristics

as management contracts.

Managed operating profit decreased by 18.0% to $41m, including

$6m (2006 $9m) from managed properties held as operating leases.

The decline in profit principally reflects increased revenue

investment to support growth in contract signings, the impact

of fewer hotels under management contracts following the

restructuring of the FelCor agreement in 2006, foreign exchange

losses in Latin America and lower ancillary revenues together with

higher costs at one of the hotels held as an operating lease. These

items reduced operating profit margins in the managed estate by

8.7 percentage points to 26.3% and reduced continuing operating

profit margins in the region by 2.0 percentage points to 48.8%.

Franchised revenue and operating profit increased by 10.4%

to $489m and 11.3% to $425m respectively, compared to 2006.

The increase was driven by RevPAR growth of 5.8%, net room

count growth of 4.0% and fees associated with growth in signings.

Regional overheads were affected positively in 2006 by lower claims

in the Group-funded employee healthcare programme. Excluding

this, regional overheads were in line with the prior period.

The Americas

Americas results

Americas comparable RevPAR movement on previous year

12 months ended

31 December 2007

Owned and leased

InterContinental 10.6%

Managed

InterContinental 10.8%

Crowne Plaza 7.2%

Holiday Inn 7.7%

Staybridge Suites 2.0%

Candlewood Suites 3.4%

Franchised

Crowne Plaza 7.6%

Holiday Inn 4.7%

Holiday Inn Express 6.7%