Holiday Inn 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 IHG Annual Report and Financial Statements 2007

Notes to the Group financial statements continued

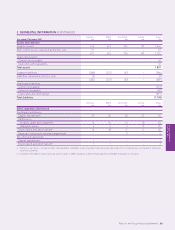

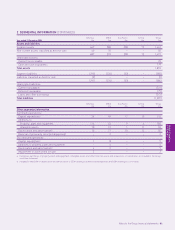

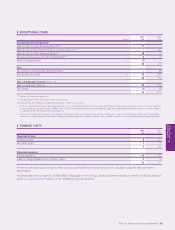

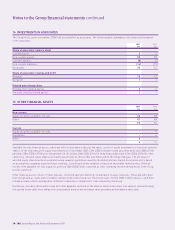

7 TAX

2007 2006

£m £m

Income tax

UK corporation tax at 30% (2006 30%):

Current period 23 16

Benefit of tax reliefs on which no deferred tax previously recognised (1) (10)

Adjustments in respect of prior periods (16) (4)

62

Foreign tax:

Current period 100 72

Benefit of tax reliefs on which no deferred tax previously recognised (8) (1)

Adjustments in respect of prior periods (50) (94)

42 (23)

Total current tax 48 (21)

Deferred tax:

Origination and reversal of temporary differences (34) 27

Changes in tax rates (2) (4)

Adjustments to estimated recoverable deferred tax assets 3(13)

Adjustments in respect of prior periods 4(24)

Total deferred tax (29) (14)

Total income tax charge/(credit) on profit for the year 19 (35)

Further analysed as tax relating to:

Profit before exceptional items 45 53

Exceptional items (note 5):

Exceptional operating items –6

Exceptional tax credit* (30) (100)

Gain on disposal of assets 46

19 (35)

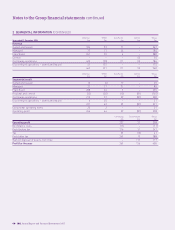

The total tax charge/(credit) can be further analysed as relating to:

Profit on continuing operations 12 (53)

Profit on discontinued operations 312

Gain on disposal of assets 46

19 (35)

* Represents the release of provisions which are exceptional by reason of their size or nature relating to tax matters which have been settled or in respect

of which the relevant statutory limitation period has expired, together with, in 2006, a credit in respect of previously unrecognised losses.

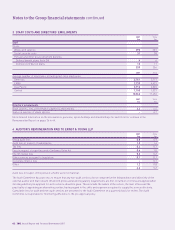

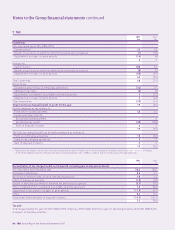

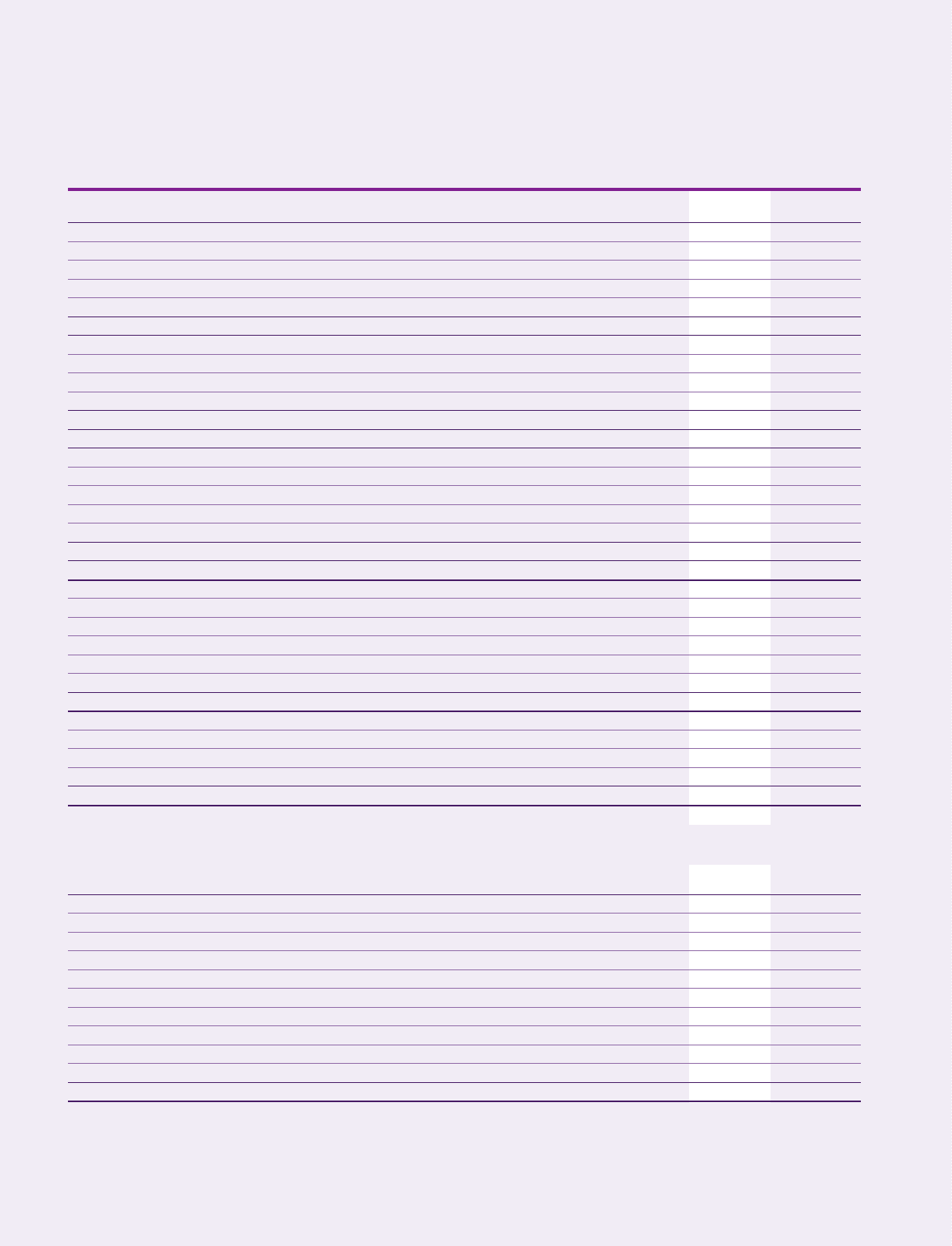

2007 2006

%%

Reconciliation of tax charge/(credit) on total profit, including gain on disposal of assets

UK corporation tax at standard rate 30.0 30.0

Permanent differences 5.6 3.7

Net effect of different rates of tax in overseas businesses 1.8 3.5

Effect of changes in tax rates (1.0) (1.0)

Benefit of tax reliefs on which no deferred tax previously recognised (3.3) (3.0)

Effect of adjustments to estimated recoverable deferred tax assets 1.3 (0.2)

Adjustment to tax charge in respect of prior periods (11.0) (6.9)

Other 0.4 0.4

Exceptional items and gain on disposal of assets (16.3) (36.1)

7.5 (9.6)

Tax paid

Total tax paid during the year of £69m (2006 £49m) comprises £37m (2006 £43m) in respect of operating activities and £32m (2006 £6m)

in respect of investing activities.