Holiday Inn 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review

Business overview

Market and competitive environment

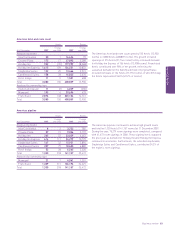

Global room capacity

The global hotel market has an estimated room capacity of

18 million rooms. Room capacity has grown at approximately

3% per annum over the last five years. Competitors in the

market include other large hotel companies and independently

owned hotels.

The market remains fragmented, with an estimated seven million

branded hotel rooms (approximately 40% of the total market). IHG

has an estimated 8% share of the branded market (approximately

3% of the total market). The top six major companies, including

IHG, together control approximately 38% of the branded rooms,

only 15% of total hotel rooms.

Geographically, the market is more concentrated with the top

20 countries accounting for 80% of global hotel rooms. Within

this, the United States (US) is dominant (more than 25% of global

hotel rooms) with China, Japan and Italy being the next largest

markets. The Group’s brands have a leadership position (top three

by room numbers) in each of the six largest geographic markets,

a greater representation than any other major hotel company.

Drivers of growth

US market data indicates a steady increase in hotel industry

revenues, broadly in line with Gross Domestic Product, with

growth of approximately 1% to 1.5% per annum in real terms

since 1967, driven by a number of underlying trends:

• change in demographics – as the population ages and

becomes wealthier, increased leisure time and income

encourages more travel and hotel visits;

• increase in travel volumes as low cost airlines grow rapidly;

• globalisation of trade and tourism;

• increase in affluence and freedom to travel within the

Chinese middle class; and

• increase in the preference for branded hotels amongst

consumers.

Branded v unbranded

2006 branded hotel rooms by region as a percentage

of the total market

US 67%

Europe, Middle East and Africa (EMEA) 35%

Asia Pacific 28%

Source: IHG Analysis, Northstar Travel Management.

Within the global market, a relatively low proportion of hotel

rooms are branded; however, there has been an increasing

trend towards branded rooms. Branded companies are therefore

gaining market share at the expense of unbranded companies.

IHG is well positioned to benefit from this trend. Hotel owners are

increasingly recognising the benefits of working with a group such

as IHG which can offer a portfolio of brands to suit the different

real estate opportunities an owner may have, together with

effective revenue delivery through global reservation channels.

Furthermore, hotel ownership is increasingly being separated

from hotel operations, encouraging hotel owners to use third

parties such as IHG to manage or franchise their hotels.

Other factors

Potential negative trends impacting hotel industry growth

include increased terrorism, environmental considerations

and economic factors such as high oil prices, risk of recession

and global credit restrictions.

Supply growth in the industry is cyclical, averaging between

zero and 5% per annum historically. The Group’s fee-based profit

is partly protected from changes of supply due to its model of

third-party ownership of hotels under IHG management and

franchise contracts.

6IHG Annual Report and Financial Statements 2007

This Business Review provides a commentary on the performance

of InterContinental Hotels Group PLC (the Group or IHG) for the

financial year ended 31 December 2007.