Holiday Inn 2007 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BUSINESS REVIEW

Business review 19

BUSINESS REVIEW

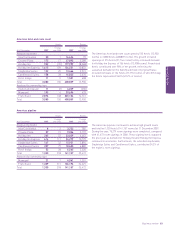

Hotels Rooms

Change Change

At 31 December 2007 over 2006 2007 over 2006

Analysed by brand

InterContinental 37 414,126 2,475

Crowne Plaza 55 317,951 1,363

Holiday Inn 94 325,858 2,083

Holiday Inn Express 11 32,600 845

Other 21 17 6,140 5,172

Total 218 30 66,675 11,938

Analysed by ownership type

Owned and leased 2–693 –

Managed 175 26 56,114 10,832

Franchised 41 49,868 1,106

Total 218 30 66,675 11,938

Hotels Rooms

Change Change

At 31 December 2007 over 2006 2007 over 2006

Analysed by brand

InterContinental 30 10 10,331 2,604

Crowne Plaza 56 35 21,028 13,421

Holiday Inn 49 16 14,370 3,980

Holiday Inn Express 22 10 6,097 1,572

Total 157 71 51,826 21,577

Analysed by ownership type

Managed 156 70 51,650 21,401

Franchised 11176 176

Total 157 71 51,826 21,577

12 months ended 31 December

2007 2006 %

£m £m change

Revenue 58 55 5.5

Gross central costs (139) (136) (2.2)

Net central costs £m (81) (81) –

Dollar equivalent $m (163) (149) (9.4)

Asia Pacific hotel and room count increased by 30 hotels

(11,938 rooms) to 218 hotels (66,675 rooms). The net growth

included 16 hotels (7,827 rooms) in Greater China reflecting

continued expansion in one of IHG’s strategic markets, together

with 15 hotels (3,542 rooms) in Japan that joined the system as

part of the IHG ANA joint venture.

The pipeline in Asia Pacific increased by 71 hotels (21,577 rooms)

to 157 hotels (51,826 rooms). Demand in the Greater China

market continued throughout the year and represented 82.3%

of the region’s room signings. From a brand perspective, Crowne

Plaza attracted significant interest, contributing over half of the

total room signings.

During 2007, net central costs were flat on 2006 but increased

in line with inflation when translated at constant currency

exchange rates.

Asia Pacific hotel and room count

Asia Pacific pipeline

Central

Central results