Holiday Inn 2007 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BUSINESS REVIEW

Business review 13

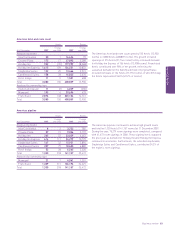

Hotels Rooms

Change Change

At 31 December 2007 over 2006 2007 over 2006

Analysed by brand

InterContinental 149 150,762 1,163

Crowne Plaza 299 24 83,170 7,538

Holiday Inn 1,381 (14) 256,699 (3,771)

Holiday Inn Express 1,808 122 156,531 12,949

Staybridge Suites 122 25 13,466 2,513

Candlewood Suites 158 28 16,825 2,676

Hotel Indigo 11 51,501 608

Other 21 17 6,140 5,172

Total 3,949 208 585,094 28,848

Analysed by ownership type

Owned and leased 18 (7) 6,396 (2,064)

Managed 539 27 134,883 9,669

Franchised 3,392 188 443,815 21,243

Total 3,949 208 585,094 28,848

During 2007, the IHG global system (the number of hotels and

rooms which are owned, leased, managed or franchised by the

Group) increased by 208 hotels (28,848 rooms, or 5.2%) to

3,949 hotels (585,094 rooms). The record growth level was driven,

in particular, by continued expansion in the US, the UK, China and

Japan, resulting in openings of 366 hotels (52,846 rooms).

Holiday Inn Express represented 58.7% of the net hotel growth,

demonstrating strong market demand in the midscale, limited

service sector. The extended stay portfolio, comprising Staybridge

Suites and Candlewood Suites hotels, expanded by 53 hotels

(5,189 rooms), indicating owner confidence in this sector.

The net decline in the Holiday Inn hotel and room count (14 hotels

and 3,771 rooms) primarily reflects IHG’s continued strategy to

reinvigorate the Holiday Inn brand through the removal of lower

quality, non-brand conforming hotels in the US. This strategy is

further supported by the worldwide brand relaunch of the Holiday

Inn brand family, announced in October 2007, which entails the

consistent delivery of best-in-class service and physical quality

in all Holiday Inn and Holiday Inn Express hotels.

At the end of 2007, the IHG pipeline (contracts signed for

hotels and rooms yet to enter the IHG global system) totalled

1,674 hotels (225,872 rooms). In the year, record room signings

across all regions of 125,533 rooms led to pipeline growth of

67,881 rooms (or 43.0%). This level of growth demonstrates

strong demand for IHG brands across all regions and represents

a key driver of future profitability.

BUSINESS REVIEW

Global hotel and room count

Global pipeline

Hotels Rooms

Change Change

At 31 December 2007 over 2006 2007 over 2006

Analysed by brand

InterContinental 62 26 20,013 6,802

Crowne Plaza 118 58 36,362 19,249

Holiday Inn 365 66 56,945 12,171

Holiday Inn Express 712 138 70,142 14,622

Staybridge Suites 157 37 17,150 4,545

Candlewood Suites 207 79 18,605 6,882

Hotel Indigo 52 28 6,565 3,520

Other 1190 90

Total 1,674 433 225,872 67,881

Analysed by ownership type

Managed 247 108 71,814 30,166

Franchised 1,427 325 154,058 37,715

Total 1,674 433 225,872 67,881

Global pipeline signings

Hotels Rooms

Change Change

At 31 December 2007 over 2006 2007 over 2006

Total 873 156 125,533 22,759