Holiday Inn 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 IHG Annual Report and Financial Statements 2007

Notes to the Group financial statements continued

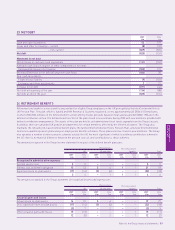

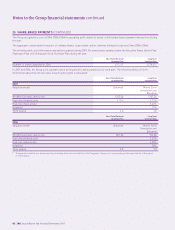

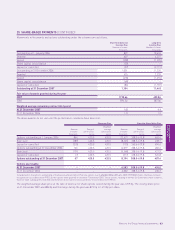

25 SHARE-BASED PAYMENTS (CONTINUED)

Summarised information about options outstanding at 31 December 2007 under the share option schemes is as follows:

Options outstanding Options exercisable

Weighted

average Weighted Weighted

Number remaining average Number average

outstanding contract life option price exercisable option price

Range of exercise prices (pence) thousands years pence thousands pence

Sharesave Plan

420.5 57 1.0 420.5 – –

Executive Share Option Plan

308.5 to 349.1 565 2.3 347.7 565 347.7

349.2 to 498.0 5,905 5.3 462.6 5,905 462.6

498.1 to 619.8 1,724 6.8 618.1 113 593.7

8,194 5.4 487.4 6,583 455.0

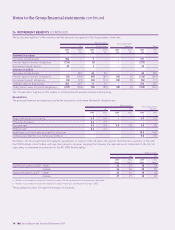

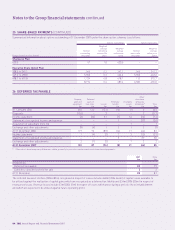

26 DEFERRED TAX PAYABLE

Other

Property, Deferred short-term

plant and gains on Employee Intangible temporary

equipment loan notes Losses benefits assets differences* Total

£m £m £m £m £m £m £m

At 1 January 2006 256 122 (123) (16) (1) 6 244

Disposals (126) –2––7(117)

Income statement (2) (26) 31 (1) 16 (32) (14)

Statement of recognised income and expense –––1–(27) (26)

Acquisition of subsidiary (note 34) ––––1–1

Exchange and other adjustments (9)(4)1212(7)

At 31 December 2006 119 92 (89) (14) 17 (44) 81

Income statement 1 (4) (2) 3 3 (30) (29)

Statement of recognised income and expense –––3–2730

Exchange and other adjustments 3(1)(3)–133

At 31 December 2007 123 87 (94) (8) 21 (44) 85

* Other short-term temporary differences relate primarily to provisions and accruals and share-based payments.

2007 2006

£m £m

Analysed as:

Deferred tax payable 82 79

Liabilities classified as held for sale 32

At 31 December 85 81

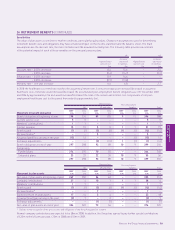

The deferred tax asset of £94m (2006 £89m) recognised in respect of losses includes £60m (2006 £64m) of capital losses available to

be utilised against the realisation of capital gains which are recognised as a deferred tax liability and £34m (2006 £25m) in respect of

revenue tax losses. Revenue losses include £3m (2006 £1m) in respect of losses which arose during a period of hotel refurbishment

and which are expected to be utilised against future operating profit.