Holiday Inn 2007 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 IHG Annual Report and Financial Statements 2007

Business review continued

Other financial information

Exceptional operating items

Exceptional operating items of £30m included an £18m gain

on the sale of financial assets and an £11m gain on the sale

of associate investments.

Exceptional operating items are treated as exceptional items

by reason of their size or nature and are excluded from the

calculation of adjusted earnings per share in order to provide

a more meaningful comparison of performance.

Net financial expenses

Net financial expenses increased from £11m in 2006 to £45m

in 2007, as a result of higher debt levels following payment

of the £709m special dividend in June 2007.

Financing costs included £10m (2006 £10m) of interest costs

associated with Priority Club Rewards where interest is charged

on the accumulated balance of cash received in advance of the

redemption points awarded. Financing costs in 2007 also included

£9m (2006 £4m) in respect of the InterContinental Boston

finance lease.

Taxation

The effective rate of tax on profit before tax, excluding the impact

of exceptional items, was 22% (2006 24%). By also excluding

the impact of prior year items, which are included wholly within

continuing operations, the equivalent tax rate would be 36%

(2006 36%). This rate is higher than the UK statutory rate of

30% due mainly to certain overseas profits (particularly in the US)

being subject to statutory rates higher than the UK statutory rate

and disallowable expenses.

Taxation within exceptional items totalled a credit of £30m

(2006 £94m credit) in respect of continuing operations. This

represented, primarily, the release of exceptional provisions

relating to tax matters which were settled during the year, or

in respect of which the statutory limitation period had expired.

In 2006, taxation exceptional items, in addition to such provision

releases, included £12m for the recognition of a deferred tax

asset in respect of tax losses.

Net tax paid in 2007 totalled £69m (2006 £49m) including £32m

(2006 £6m) in respect of disposals.

Earnings per share

Basic earnings per share in 2007 were 72.2p, compared with 104.1p

in 2006. Adjusted earnings per share were 48.4p, against 42.9p in

2006.

Adjusted continuing earnings per share were 46.9p, 23.4% up

on last year.

Dividends

The Board has proposed a final dividend per share of 14.9p;

with the interim dividend per share of 5.7p, the normal dividend

per share for 2007 will total 20.6p.

Share price and market capitalisation

The IHG share price closed at 884.0p on 31 December 2007, down

from 1262.0p on 31 December 2006. The market capitalisation of

the Group at the year end was £2.6bn.

Cash flow

The net movement in cash and cash equivalents in the 12 months

to 31 December 2007 was an outflow of £131m. This included net

cash inflows from operating activities of £232m, net cash

overflows from investing activities of £19m and net cash outflows

from financing activities of £344m.

Key components of investing and financing activities included:

• proceeds from the disposal of hotels and equity investments

totalled £106m;

• capital expenditure totalled £93m and included the completion

of the major refurbishment at the InterContinental London

Park Lane and the renovation works at the InterContinental

Hong Kong;

• cash outflows associated with shareholder returns during the

year included a special dividend of £709m and share buybacks

of £81m; and

• increased borrowings of £553m.

IHG’s cash flow strategy has focused on reducing capital

intensity and returning surplus funds to shareholders. Capital

investment in new projects will be made where this creates value

by accelerating the development of IHG’s brands. Such investment

will be funded largely from the proceeds of hotel and minority

shareholding disposals, with the objective of subsequently

recycling that capital into other projects.

Capital structure and liquidity management

Net debt at 31 December 2007 was £825m and included £100m

in respect of the finance lease commitment for the

InterContinental Boston.

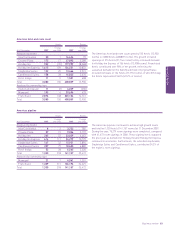

2007 2006

Net debt at 31 December £m £m

Borrowings (including derivatives):

Sterling 275 102

US dollar 439 282

Euro 121 101

Other 48 48

Cash (including derivatives) (58) (403)

825 130

Excluding fair value of derivatives (net) –4

Net debt 825 134

Average debt levels 536 92

2007 2006

Facilities at 31 December £m £m

Committed 1,154 1,157

Uncommitted 25 39

Total 1,179 1,196

Interest risk profile of net

debt for major currencies (including 2007 2006

derivatives) at 31 December %%

At fixed rates 45 57

At variable rates 55 43