Holiday Inn 2007 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 IHG Annual Report and Financial Statements 2007

Business review continued

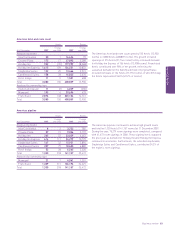

12 months ended 31 December

2007 2006 %

$m $m change

Revenue

Owned and leased 145 131 10.7

Managed 99 65 52.3

Franchised 16 8 100.0

Total $m 260 204 27.5

Sterling equivalent £m 130 111 17.1

Operating profit before exceptional items

Owned and leased 36 31 16.1

Managed 46 39 17.9

Franchised 65 20.0

88 75 17.3

Regional overheads (25) (23) (8.7)

Total $m 63 52 21.2

Sterling equivalent £m 31 29 6.9

Asia Pacific comparable RevPAR movement on previous year

12 months ended

31 December 2007

Owned and leased

InterContinental 7.3%

All ownership types

Greater China 7.0%

Asia Pacific revenue increased by 27.5% to $260m whilst

operating profit increased by 21.2% to $63m.

The region achieved strong RevPAR growth across all brands and

ownership types and continued its strategic expansion in China

and Japan. Strong growth in total profit was achieved; however,

revenue conversion was impacted by continued investment to

support expansion, resulting in a 1.3 percentage point reduction

in operating profit margins to 24.2%.

In the owned and leased estate, revenue increased by 10.7% to

$145m due to the combined impact of strong room and food and

beverage trading at the InterContinental Hong Kong, despite the

impact of renovation works throughout a significant part of the

year. The hotel’s revenue growth combined with profit margin

gains drove the estate’s operating profit growth of 16.1% to $36m.

Managed revenues increased by 52.3% to $99m as a result of

the full year contribution from the hotels which joined the system

in 2006 as part of the IHG ANA joint venture in Japan, continued

organic expansion in China and solid RevPAR growth across

Southern Asia and Australia. Operating profit increased by

17.9% to $46m as revenue gains were offset by integration

and ongoing costs associated with the ANA joint venture and

continued infrastructure investment in China.

Franchised revenues doubled from $8m to $16m, primarily driven

by hotels in the IHG ANA joint venture. Similar to the managed

operations, growth in profitability was impacted by ANA

integration and ongoing costs.

Regional overheads increased by $2m to $25m primarily as a

result of investment in technology and corporate infrastructure

in China and Japan and included the favourable impact of a

legal settlement.

Asia Pacific

Asia Pacific results