Holiday Inn 2007 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BUSINESS REVIEW

Business review 21

BUSINESS REVIEW

Treasury policy is to manage financial risks that arise in relation

to underlying business needs. The activities of the treasury

function are carried out in accordance with Board approved

policies and are subject to regular audit. The treasury function

does not operate as a profit centre.

Medium and long-term borrowing requirements at 31 December

2007 were met through a £1.1bn Syndicated Bank Facility which

matures in November 2009. Short-term borrowing requirements

were principally met from drawings under committed and

uncommitted bilateral loan facilities. At the year end, the Group

had £377m of committed facilities available for drawing.

In the year, IHG paid a £709m special dividend, completed a third

£250m share buyback and commenced a £150m share buyback.

At the year end, £100m of this buyback was outstanding.

Since March 2004, IHG has returned £3.5bn to shareholders.

The Syndicated Bank Facility contains two financial covenants,

interest cover and net debt/earnings before interest, tax, depreciation

and amortisation. The Group is in compliance with both

covenants, neither of which is expected to represent a material

restriction on funding or investment policy in the foreseeable future.

Further information on the Group’s treasury management can be

found in note 21 on page 74 in the notes to the Group Financial

Statements 2007.

During 2007, IHG achieved further progress with its asset disposal

programme, including:

• the sale of the Crowne Plaza Santiago for $21m before

transaction costs, approximately $9m above net book value.

Under the agreement, IHG retained a 10 year franchise contract;

• the sale of its 74.11% share of the InterContinental Montreal

for £17m before transaction costs, approximately £5m above

book value. Under the agreement, IHG retained a 30 year

management contract on the hotel; and

• the sale of the Holiday Inn Disney, Paris for £14m before

transaction costs, approximately £2m above book value. Under

the agreement, IHG retained a five year franchise contract.

These transactions support IHG’s continued strategy of growing its

managed and franchised business whilst reducing asset ownership.

Since April 2003, 181 hotels with a net book value of £2.9bn have

been sold, generating aggregate proceeds of £3.0bn, of which 162

of these hotels remained in the IHG system through the successful

negotiation of either management or franchise agreements.

During 2007, IHG also divested a number of equity interests

of which proceeds totalled £57m, including a 33.3% interest in

the Crowne Plaza London The City for £19m and a 15% interest

in the InterContinental Chicago for £11m.

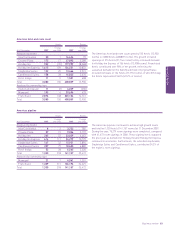

Asset disposal programme

Number Net book

of hotels Proceeds value

Disposed since April 2003 181 £3.0bn £2.9bn

Remaining owned and leased hotels 18 £0.9bn

Return of funds programme

Total Returned Still to

Timing return to date be returned

£501m special dividend Paid in December 2004 £501m £501m Nil

First £250m share buyback Completed in 2004 £250m £250m Nil

£996m capital return Paid in July 2005 £996m £996m Nil

Second £250m share buyback Completed in 2006 £250m £250m Nil

£497m special dividend Paid in June 2006 £497m £497m Nil

Third £250m share buyback Completed in 2007 £250m £250m Nil

£709m special dividend Paid in June 2007 £709m £709m Nil

£150m share buyback Under way £150m £50m £100m

Total £3,603m £3,503m £100m