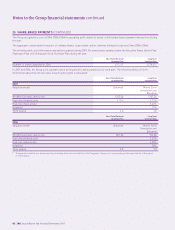

Holiday Inn 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP FINANCIAL

STATEMENTS

GROUP FINANCIAL

STATEMENTS

Notes to the Group financial statements 75

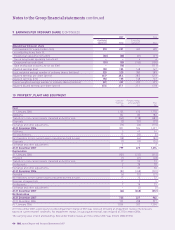

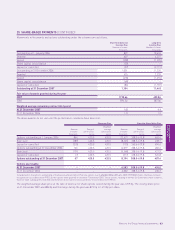

22 FINANCIAL INSTRUMENTS

Liquidity risk

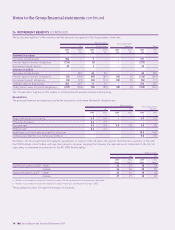

The following are the undiscounted contractual cash flows of financial liabilities, including interest payments.

Less than Between 1 and Between 2 and More than

1 year 2 years 5 years 5 years Total

£m £m £m £m £m

31 December 2007

Secured bank loans 114–6

Finance lease obligations 8 8 24 1,689 1,729

Unsecured bank loans 781 – – – 781

Trade and other payables 388 64 50 55 557

Derivatives 6–––6

Less than Between 1 and Between 2 and More than

1 year 2 years 5 years 5 years Total

£m £m £m £m £m

31 December 2006

Secured bank loans 4 1 5 – 10

Finance lease obligations 3 8 25 1,745 1,781

Unsecured bank loans 214 – – – 214

Trade and other payables 402 47 36 53 538

Derivatives 57 – – – 57

Cash flows relating to unsecured bank loans are classified according to the maturity date of the loan drawdown rather than the facility

maturity date.

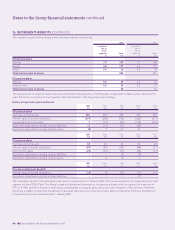

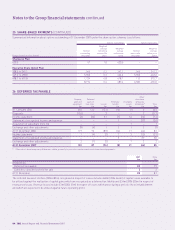

Credit risk

The carrying amount of financial assets represents the maximum exposure to credit risk.

2007 2006

£m £m

Equity securities available-for-sale 46 57

Loans and receivables:

Cash and cash equivalents 52 179

Other financial assets 56 48

Trade and other receivables, excluding prepayments 209 214

Derivatives –4

363 502

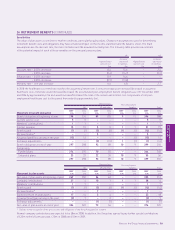

Interest rate risk

For each class of interest bearing financial asset and financial liability, the following table indicates the range of interest rates effective at

the balance sheet date, the carrying amount on the balance sheet and the periods in which they reprice, if earlier than the maturity date.

Repricing analysis

Effective Total Between

interest carrying Less than 6 months Between 1 and More than

rate amount 6 months and 1 year 2 years 5 years

%£m£m£m£m£m

31 December 2007

Cash and cash equivalents 0.0-5.9 (52) (52) – – –

Secured bank loans 8.233–––

Finance lease obligations* 9.7 100 – – – 100

Unsecured bank loans:

Euro floating rate 5.3 121 121 – – –

– effect of euro interest rate swaps* (0.6) – (55) – 55 –

US dollar floating rate 5.5 333 333 – – –

– effect of US dollar interest rate swaps* (0.4) – (50) 50 – –

Sterling floating rate 6.9 275 275 – – –

– effect of sterling interest rate swaps 0.0 – (75) – 75 –

HK dollar floating rate 4.54545 – – –

Net debt 825 545 50 130 100

* These items bear interest at a fixed rate.