Holiday Inn 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 IHG Annual Report and Financial Statements 2007

Notes to the Group financial statements continued

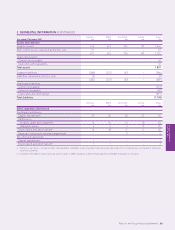

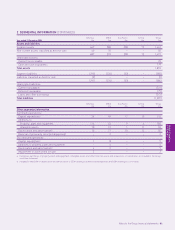

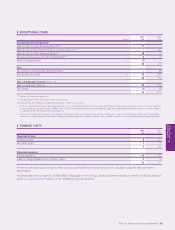

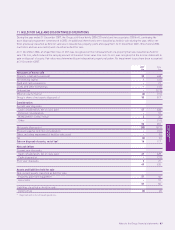

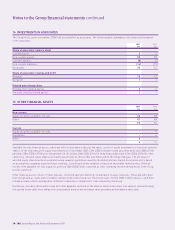

11 HELD FOR SALE AND DISCONTINUED OPERATIONS (CONTINUED)

2007 2006

£m £m

Results of discontinued operations

Revenue 40 174

Cost of sales (30) (134)

10 40

Depreciation and amortisation (2) (9)

Operating profit 831

Tax (3) (12)

Profit after tax 519

Gain on disposal of assets, net of tax (note 5) 16 117

Profit for the year from discontinued operations 21 136

2007 2006

pence pence

per share per share

Earnings per share from discontinued operations

Basic 6.6 35.0

Diluted 6.4 34.1

2007 2006

£m £m

Cash flows attributable to discontinued operations

Operating profit before interest, depreciation and amortisation 10 40

Investing activities (1) (9)

Financing activities –(25)

The effect of discontinued operations on segmental results is shown in note 2.

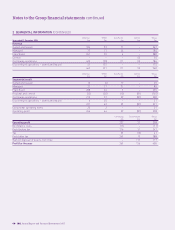

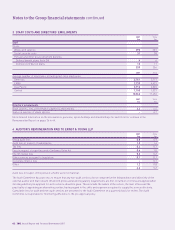

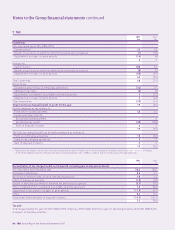

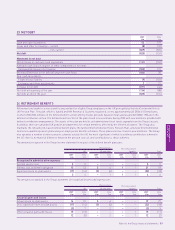

12 GOODWILL

2007 2006

£m £m

At 1 January 109 118

Acquisition of subsidiary (note 34) –2

Exchange and other adjustments 1(11)

At 31 December 110 109

Goodwill arising on business combinations that occurred before 1 January 2005 was not restated on adoption of IFRS as permitted by IFRS 1.

Goodwill has been allocated to cash-generating units (CGUs) for impairment testing as follows:

2007 2006

£m £m

Americas managed operations 70 72

Asia Pacific managed and franchised operations 40 37

110 109

The Group tests goodwill for impairment annually, or more frequently if there are any indications that an impairment may have arisen.

The recoverable amounts of the CGUs are determined from value in use calculations. The key assumptions for the value in use

calculations are those regarding discount rates and growth rates. Management estimates discount rates using pre-tax rates that reflect

current market assessments of the time value of money and the risks specific to the CGUs. Growth rates are based on management

expectations and industry growth forecasts. The growth rates used to determine cash flows beyond five years do not exceed the average

long-term growth rate for the relevant markets.