Holiday Inn 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE BOARD, SENIOR

MANAGEMENT AND

THEIR RESPONSIBILITIES

Remuneration report 43

THE BOARD, SENIOR

MANAGEMENT AND

THEIR RESPONSIBILITIES

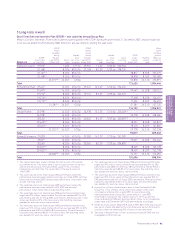

Share options

Between 2003 and 2005, grants of options were made under the IHG Executive Share Option Plan. No executive share options have been

granted since 2005. In 2003, a grant of options was made under the IHG all-employee Sharesave Plan.

Ordinary shares under option Weighted

Options Granted Lapsed Exercised Options average

held at during during during held at option Option

Directors 1 Jan 2007 the year the year the year 31 Dec 2007 price (p) price (p)

Andrew Cosslett 157,300

B157,300 619.83

Total 157,300 – – – 157,300 619.83

Richard Hartman 337,760

218,950 494.17

B118,810 619.83

Total 337,760 – – 218,950 118,810 619.83

Stevan Porter 321,630

A225,260 494.17

B96,370 619.83

Total 321,630 – – – 321,630 531.82

Richard Solomons 334,639

A230,320 494.17

B100,550 619.83

C3,769 420.50

Total 334,639 – – – 334,639 531.10

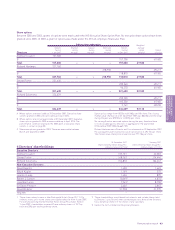

31 December 2007 1 January 2007

InterContinental Hotels Group PLC InterContinental Hotels Group PLC

6 Directors’ shareholdings ordinary shares of 13 29⁄47p2ordinary shares of 11 3⁄7p1

Executive Directors

Andrew Cosslett 133,101 42,063

Stevan Porter 168,162 114,446

Richard Solomons 156,810 104,247

Non-Executive Directors

David Kappler 1,400 1,669

Ralph Kugler 1,169 572

Jennifer Laing 1,404 875

Robert C Larson 10,26936,8743

Jonathan Linen 7,34338,7503

Sir David Prosser 2,402 2,863

David Webster 31,938 31,975

Ying Yeh ––

A Where options are exercisable at 31 December 2007. Executive share

options granted in 2004 are exercisable up to April 2014.

B Where options are not yet exercisable at 31 December 2007. Executive

share options granted in 2005 are exercisable up to April 2015. The

performance condition relating to the 2005 grant of executive share

options is set out on page 38.

C Sharesave options granted in 2003. These are exercisable between

March and September 2009.

Option prices range from 420.50p to 619.83p per IHG share. The closing

market value share price on 31 December 2007 was 884.00p and the range

during the year was 873.50p to 1413.00p per share.

No serving Director exercised options during the year; therefore there

is no disclosable gain by Directors in aggregate for the year ended

31 December 2007 (2006 £6,662,750).

Richard Hartman was a Director until his retirement on 25 September 2007.

He subsequently exercised options at an option price of 494.17p per share.

The market value share price on exercise was 911.78p per share.

1 These share interests were in InterContinental Hotels Group PLC 11 3⁄7p

ordinary shares prior to the share consolidation effective from 4 June 2007.

For every 56 existing InterContinental Hotels Group PLC shares held on

1 June 2007, shareholders received 47 new ordinary shares of 13 29⁄47p

each and 200p per existing ordinary share.

2 These shareholdings are all beneficial interests and include shares held

by Directors’ spouses and other connected persons. None of the Directors

has a beneficial interest in the shares of any subsidiary.

3 Held in the form of American Depositary Receipts.