Holiday Inn 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE BOARD, SENIOR

MANAGEMENT AND

THEIR RESPONSIBILITIES

Corporate governance and Audit Committee report 35

THE BOARD, SENIOR

MANAGEMENT AND

THEIR RESPONSIBILITIES

Audit Committee report

The Audit Committee assists the Board in meeting its

responsibilities in relation to the integrity of the Group’s financial

statements and associated announcements, the adequacy

of internal control and risk management systems and the

appointment and work of the internal and external auditors.

The role of the Audit Committee is summarised below and in

full in its terms of reference, a copy of which is available on

the Company’s website or in writing on request.

The Committee’s composition, and the attendance of its members,

all of whom served throughout 2007, are set out on page 32.

The Committee’s Chairman and financial expert, David Kappler,

is a chartered management accountant and until April 2004 was

Chief Financial Officer of Cadbury Schweppes plc. He also chairs

the Audit Committee of another UK FTSE 100 company.

The Committee’s principal responsibilities are to:

• review the Group’s public statements on internal control and

corporate governance compliance prior to their consideration

by the Board;

• review the Group’s processes for detecting and addressing

fraud, misconduct and control weaknesses and to consider

the response to any such occurrence, including overseeing

the process enabling the anonymous submission of concerns;

• review reports from management, internal audit and external

audit concerning the effectiveness of internal control, financial

reporting and risk management processes;

• review with management and the external auditor any financial

statements required under UK or US legislation before

submission to the Board;

• establish, review and maintain the role and effectiveness

of the internal audit function, including overseeing the

appointment of the Head of Internal Audit;

• assume responsibility for the appointment, compensation,

resignation, dismissal and the overseeing of the external auditor,

including review of the external audit, its cost and effectiveness;

• pre-approve non-audit work to be carried out by the external

auditor, and the fees to be paid for that work, along with the

monitoring of the external auditor’s independence; and

• oversee the Group’s Code of Ethics and Business Conduct

and associated procedures for monitoring adherence.

The Committee discharges its responsibilities through a series of

Audit Committee meetings during the year, at which detailed reports

are presented for review. The Committee commissions reports,

either from external advisers, the Head of Internal Audit, or Group

management, after consideration of the major risks to the Group

or in response to developing issues. The external auditor attends

its meetings as does the Head of Internal Audit, both of whom

have the opportunity to meet privately with the Committee, in the

absence of Group management, at the conclusion of each meeting.

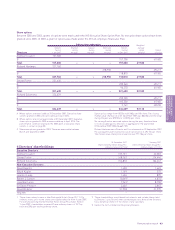

All proposals for the provision of non-audit services by the

external auditor are pre-approved by the Audit Committee or its

delegated member, the overriding consideration being to ensure

that the provision of non-audit services does not impact the

external auditor’s independence and objectivity.

During the year, the Committee’s deliberations included the

following matters:

• quarterly, interim and full-year financial results. These

public financial statements are reviewed by the Committee

in advance of their consideration by the Board. Adequate time

is allowed between the Committee’s review and the Board’s

approval for any actions or further work requested by the

Committee to be completed;

• the scope and cost of the external audit;

• any non-audit work carried out by the Group’s external auditor

(and trends in the non-audit fees) in accordance with the

Committee’s policy to ensure the safeguarding of audit

independence and objectivity;

• the external auditor’s quarterly, interim and full-year reports;

• the effectiveness of the external auditor and consideration

of their objectivity, independence and reappointment;

• the scope of the annual internal audit plan, the internal audit

department’s approach to delivering assurance, its resourcing

and the results of its reviews;

• the effectiveness of the internal audit function and its

compliance with professional standards;

• any major changes in the Group’s internal controls;

• the co-ordination of the internal and external audit functions;

• the Group’s framework for the identification and control of

major risks, and the results of the Group’s risk review process;

• corporate governance developments in the UK and the US;

• reports from the Head of Group Risk Management on the

activities of that function;

• consideration of the results of the Group’s tangible asset

impairment review;

• overseeing the Group’s Sarbanes-Oxley Act compliance work;

• the disclosure controls and procedures operated by the Group,

with reference to periodic reports from the Chairman of the

Disclosure Committee;

• reviewing the Group’s approach to managing tax risk;

• consideration of the Group’s treasury objectives and policies;

• a review of changes to the Group’s policy on delegation

of authority;

• a review of the funding position and governance of the

Group’s main pension plan;

• periodic reports on any significant incidents of fraud or any

allegations made via the Group’s whistleblowing procedures

and the effectiveness of these procedures;

• any material litigation involving the Group; and

• consideration of the effectiveness of the Audit Committee

and the continuing appropriateness of its terms of reference.

David Kappler

Chairman of the Audit Committee

18 February 2008