Holiday Inn 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 IHG Annual Report and Financial Statements 2007

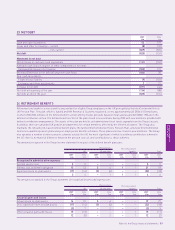

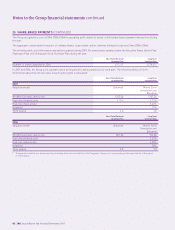

25 SHARE-BASED PAYMENTS (CONTINUED)

The Group recognised a cost of £30m (2006 £18m) in operating profit related to equity-settled share-based payment transactions during

the year.

The aggregate consideration in respect of ordinary shares issued under option schemes during the year was £16m (2006 £20m).

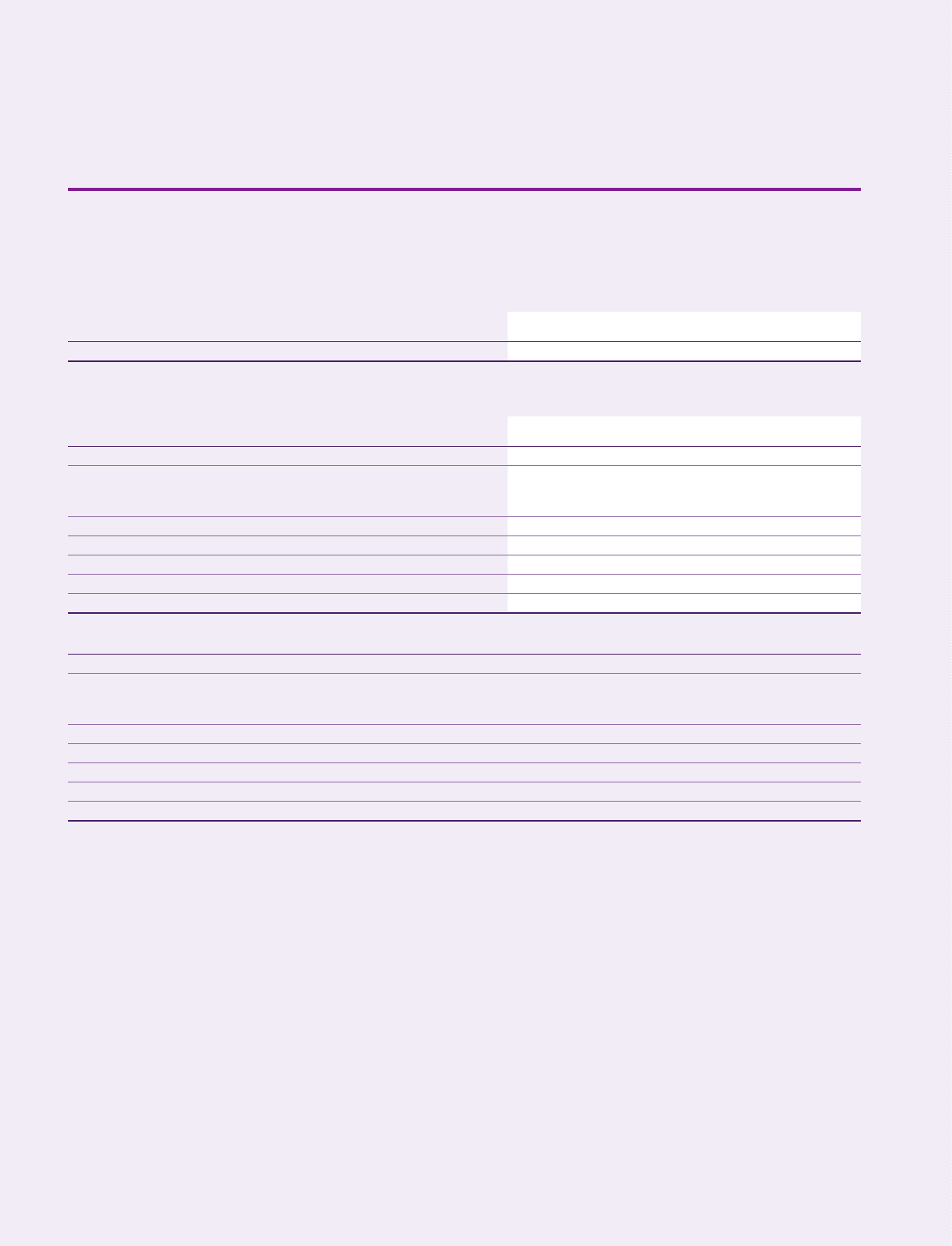

The following table sets forth awards and options granted during 2007. No awards were granted under the Executive Share Option Plan,

Sharesave Plan or US Employee Stock Purchase Plan during the year.

Short Term Deferred Long Term

Incentive Plan Incentive Plan

Number of shares awarded in 2007 675,515 3,538,535

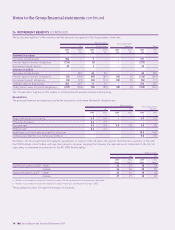

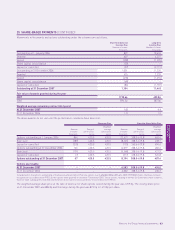

In 2007 and 2006, the Group used separate option pricing models and assumptions for each plan. The following tables set forth

information about how the fair value of each option grant is calculated:

Short Term Deferred Long Term

Incentive Plan Incentive Plan

2007

Valuation model Binomial Monte Carlo

Simulation and

Binomial

Weighted average share price 1252.0p 1262.0p

Expected dividend yield 2.13% 2.13%

Risk-free interest rate 5.40%

Volatility* 19%

Term (years) 3.0 3.0

Short Term Deferred Long Term

Incentive Plan Incentive Plan

2006

Valuation model Binomial Monte Carlo

Simulation and

Binomial

Weighted average share price 831.0p 946.0p

Expected dividend yield 2.32%

Risk-free interest rate 4.90%

Volatility* 20%

Term (years) 2.0 3.0

* The expected volatility was determined by calculating the historical volatility of the Company’s share price corresponding to the expected life of the option

or share award.

Notes to the Group financial statements continued