Holiday Inn 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP FINANCIAL

STATEMENTS

Corporate information and accounting policies 55

GROUP FINANCIAL

STATEMENTS

Deferred tax assets are recognised to the extent that it is regarded

as probable that the deductible temporary differences can be

realised. The recoverability of all deferred tax assets is reassessed

at each balance sheet date.

Deferred tax is calculated at the tax rates that are expected to

apply in the periods in which the asset or liability will be settled,

based on rates enacted or substantively enacted at the balance

sheet date.

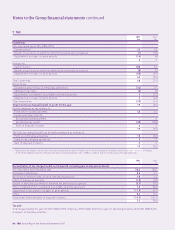

Revenue recognition

Revenue is derived from the following sources: owned and leased

properties; management fees; franchise fees and other revenues

which are ancillary to the Group’s operations.

Generally, revenue represents sales (excluding VAT and similar

taxes) of goods and services, net of discounts, provided in the

normal course of business and recognised when services have

been rendered. The following is a description of the composition

of revenues of the Group.

Owned and leased – primarily derived from hotel operations,

including the rental of rooms and food and beverage sales from

owned and leased hotels operated under the Group’s brand

names. Revenue is recognised when rooms are occupied and

food and beverages are sold.

Management fees – earned from hotels managed by the

Group, usually under long-term contracts with the hotel owner.

Management fees include a base fee, which is generally a

percentage of hotel revenue, and an incentive fee, which is

generally based on the hotel’s profitability or cash flows. Revenue

is recognised when earned and realised or realisable under

the terms of the contract.

Franchise fees – received in connection with the license of the

Group’s brand names, usually under long-term contracts with

the hotel owner. The Group charges franchise royalty fees as a

percentage of room revenue. Revenue is recognised when earned

and realised or realisable under the terms of the agreement.

Share-based payments

The cost of equity-settled transactions with employees is

measured by reference to fair value at the date at which the

shares are granted. Fair value is determined by an external

valuer using option pricing models.

The cost of equity-settled transactions is recognised, together

with a corresponding increase in equity, over the period in which

any performance conditions are fulfilled, ending on the date on

which the relevant employees become fully entitled to the award

(vesting date).

The income statement charge for a period represents the

movement in cumulative expense recognised at the beginning and

end of that period. No expense is recognised for awards that do

not ultimately vest, except for awards where vesting is conditional

upon a market condition, which are treated as vesting irrespective

of whether or not the market condition is satisfied, provided that

all other performance conditions are satisfied.

The Group has taken advantage of the transitional provisions of

IFRS 2 ‘Share-based Payments’ in respect of equity-settled awards

and has applied IFRS 2 only to equity-settled awards granted after

7 November 2002 that had not vested before 1 January 2005.

Leases

Operating lease rentals are charged to the income statement

on a straight-line basis over the term of the lease.

Assets held under finance leases, which transfer to the Group

substantially all the risks and benefits incidental to ownership

of the leased item, are capitalised at the inception of the lease,

with a corresponding liability being recognised for the fair value

of the leased asset or, if lower, the present value of the minimum

lease payments. Lease payments are apportioned between the

reduction of the lease liability and finance charges in the income

statement so as to achieve a constant rate of interest on the

remaining balance of the liability. Assets held under finance

leases are depreciated over the shorter of the estimated useful

life of the asset and the lease term.

Disposal of non-current assets

The Group recognises the sales proceeds and related gain or loss

on disposal on completion of the sales process. In determining

whether the gain or loss should be recorded, the Group considers

whether it:

• has a continuing managerial involvement to the degree

associated with asset ownership;

• has transferred the significant risks and rewards associated

with asset ownership; and

• can reliably measure and will actually receive the proceeds.

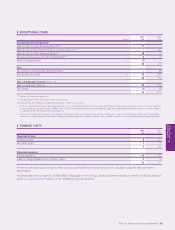

Discontinued operations

Discontinued operations are those relating to hotels sold or those

classified as held for sale when the results relate to a separate

line of business, geographical area of operations, or where there

is a co-ordinated plan to dispose of a separate line of business

or geographical area of operations.

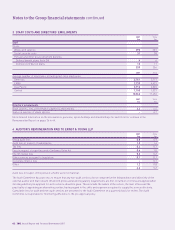

Exceptional items

The Group discloses certain financial information both including

and excluding exceptional items. The presentation of information

excluding exceptional items allows a better understanding of

the underlying trading performance of the Group and provides

consistency with the Group’s internal management reporting.

Exceptional items are identified by virtue of either their size or

nature so as to facilitate comparison with prior periods and to

assess underlying trends in financial performance. Exceptional

items can include, but are not restricted to, gains and losses

on the disposal of assets, impairment charges and reversals,

restructuring costs and the release of tax provisions.

Amounts that have previously been disclosed as special items

have now been called exceptional items in accordance with

market practice. There has been no change to the Group’s

accounting policy for identifying these items.