Holiday Inn 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP FINANCIAL

STATEMENTS

Notes to the Group financial statements 73

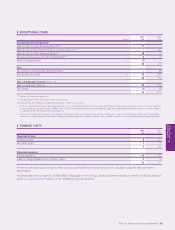

20 LOANS AND OTHER BORROWINGS (CONTINUED)

Secured bank loans

These mortgages are secured on the hotel properties to which they relate. The rates of interest and currencies of these loans vary.

Finance leases

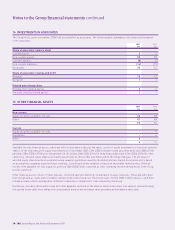

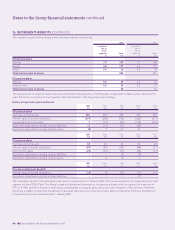

Finance lease obligations, which relate to the 99 year lease on the InterContinental Boston, are payable as follows:

2007 2006

Minimum Present Minimum Present

lease value of lease value of

payments payments payments payments

£m £m £m £m

Less than one year 8833

Between one and five years 32 24 33 24

More than five years 1,689 68 1,745 70

1,729 100 1,781 97

Less: amount representing finance charges (1,629) – (1,684) –

100 100 97 97

The Group has the option to extend the term of the lease for two additional 20 year terms. Payments under the lease step up at regular

intervals over the lease term.

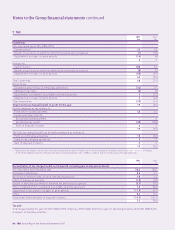

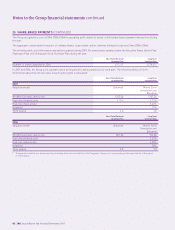

Unsecured bank loans

Unsecured bank loans are borrowings under the Group’s 2009 £1.1bn Syndicated Facility and its short-term bilateral loan facilities.

Amounts are classified as non-current when the facilities have more than 12 months to expiry. These facilities contain financial

covenants and as at the balance sheet date the Group was not in breach of these covenants, nor had any breaches or defaults occurred

during the year.

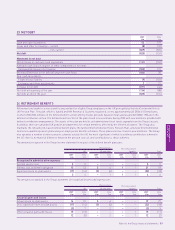

2007 2006

Utilised Unutilised Total Utilised Unutilised Total

Facilities provided by banks £m £m £m £m £m £m

Committed 777 377 1,154 213 944 1,157

Uncommitted –2525 33639

777 402 1,179 216 980 1,196

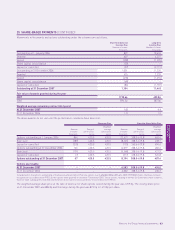

2007 2006

£m £m

Unutilised facilities expire:

Within one year 75 86

After one but before two years 327 –

After two years –894

402 980

GROUP FINANCIAL

STATEMENTS

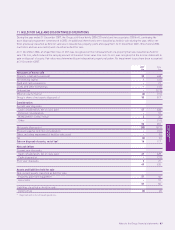

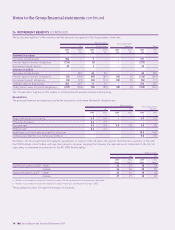

21 FINANCIAL RISK MANAGEMENT POLICIES

Overview

The Group’s treasury policy is to manage financial risks that

arise in relation to underlying business needs. The activities

of the treasury function are carried out in accordance with Board

approved policies and are subject to regular audit. The treasury

function does not operate as a profit centre.

The treasury function seeks to reduce the financial risk of the

Group and manages liquidity to meet all foreseeable cash needs.

Treasury activities include money market investments, spot

and forward foreign exchange instruments, currency options,

currency swaps, interest rate swaps and options and forward

rate agreements. One of the primary objectives of the Group’s

treasury risk management policy is to mitigate the adverse impact

of movements in interest rates and foreign exchange rates.

Market risk exposure

The US dollar is the predominant currency of the Group’s

revenue and cash flows. Movements in foreign exchange rates,

particularly the US dollar and euro, can affect the Group’s

reported profit, net assets and interest cover. To hedge this

translation exposure the Group matches the currency of its

debt (either directly or via derivatives) to the currency of its net

assets, whilst maximising the amount of US dollars borrowed.

Foreign exchange transaction exposure is managed by the

forward purchase or sale of foreign currencies or the use of

currency options. Most significant exposures of the Group

are in currencies that are freely convertible.