Holiday Inn 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP FINANCIAL

STATEMENTS

Corporate information and accounting policies 53

GROUP FINANCIAL

STATEMENTS

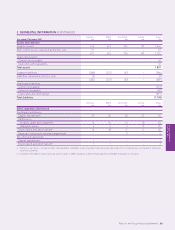

Property, plant and equipment are reviewed for impairment

when events or changes in circumstances indicate that the

carrying value may not be recoverable. Assets that do not

generate independent cash flows are combined into cash-

generating units. If carrying values exceed estimated recoverable

amount, the assets or cash-generating units are written down

to their recoverable amount. Recoverable amount is the greater

of fair value less cost to sell and value in use. Value in use is

assessed based on estimated future cash flows discounted to

their present value using a pre-tax discount rate that reflects

current market assessments of the time value of money and

the risks specific to the asset.

On adoption of IFRS, the Group retained previous revaluations

of property, plant and equipment at deemed cost as permitted

by IFRS 1 ‘First-time Adoption of International Financial

Reporting Standards’.

Goodwill

Goodwill arises on consolidation and is recorded at cost, being

the excess of the cost of acquisition over the fair value at the date

of acquisition of the Group’s share of identifiable assets, liabilities

and contingent liabilities. Following initial recognition, goodwill is

measured at cost less any accumulated impairment losses.

Goodwill is tested for impairment at least annually by comparing

carrying values of cash-generating units with their recoverable

amounts.

Intangible assets

Software

Acquired software licences and software developed in-house are

capitalised on the basis of the costs incurred to acquire and bring

to use the specific software. Costs are amortised over estimated

useful lives of three to five years on a straight-line basis.

Management contracts

When assets are sold and a purchaser enters into a management

or franchise contract with the Group, the Group capitalises as part

of the gain or loss on disposal an estimate of the fair value of the

contract entered into. The value of management contracts is

amortised over the life of the contract which ranges from six to

50 years on a straight-line basis.

Other intangible assets

Amounts paid to hotel owners to secure management contracts

and franchise agreements are capitalised and amortised over

the shorter of the contracted period and 10 years on a straight-

line basis.

Internally generated development costs are expensed unless

forecast revenues exceed attributable forecast development costs,

at which time they are capitalised and amortised over the life of

the asset.

Intangible assets are reviewed for impairment when events or

changes in circumstances indicate that the carrying value may

not be recoverable.

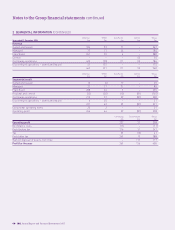

Associates

An associate is an entity over which the Group has the ability to

exercise significant influence, but not control, through participation

in the financial and operating policy decisions of the entity.

Associates are accounted for using the equity method unless the

associate is classified as held for sale. Under the equity method,

the Group’s investment is recorded at cost adjusted by the Group’s

share of post acquisition profits and losses. When the Group’s

share of losses exceeds its interest in an associate, the Group’s

carrying amount is reduced to £nil and recognition of further

losses is discontinued except to the extent that the Group has

incurred legal or constructive obligations or made payments

on behalf of an associate.

Financial assets

The Group classifies its financial assets into one of the two

following categories: loans and receivables or available-for-sale

financial assets. Management determines the classification on

initial recognition and they are subsequently held at amortised

cost (loans and receivables) or fair value (available-for-sale

financial assets). Interest on loans and receivables is calculated

using the effective interest rate method and is recognised in the

income statement as interest income. Changes in fair values of

available-for-sale financial assets are recorded directly in equity

within the unrealised gains and losses reserve. On disposal, the

accumulated fair value adjustments recognised in equity are

recycled to the income statement. Dividends from available-for-

sale financial assets are recognised in the income statement as

other operating income and expenses.

Financial assets are tested for impairment at each balance sheet

date. If an available-for-sale financial asset is impaired, the

difference between original cost and fair value is transferred from

equity to the income statement to the extent of any cumulative

loss recorded in equity, with any excess charged directly to the

income statement.

Financial liabilities

Financial liabilities are measured at amortised cost using the

effective interest rate method. A financial liability is derecognised

when the obligation under the liability expires, is discharged

or cancelled.

Inventories

Inventories are stated at the lower of cost and net realisable value.

Trade receivables

Trade receivables are recorded at their original amount less

provision for impairment. It is the Group’s policy to provide for

100% of the previous month’s aged receivables balances which

are more than 180 days past due. Adjustments to the policy may

be made due to specific or exceptional circumstances when

collection is no longer considered probable. The carrying amount

of the receivable is reduced through the use of a provision account

and movements in the provision are recognised in the income

statement within cost of sales. When a previously provided trade

receivable is uncollectable, it is written off against the provision.