Holiday Inn 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 IHG Annual Report and Financial Statements 2007

Notes to the Group financial statements continued

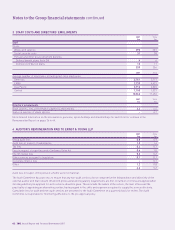

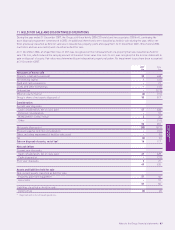

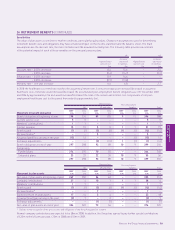

17 TRADE AND OTHER RECEIVABLES (CONTINUED)

The movement in the provision for impairment of trade and other receivables during the year is as follows:

2007 2006

£m £m

At 1 January (43) (47)

Provided (12) (16)

Amounts written off 615

Exchange and other adjustments 15

At 31 December (48) (43)

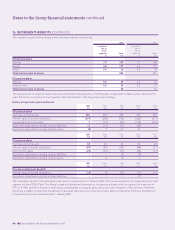

18 CASH AND CASH EQUIVALENTS

2007 2006

£m £m

Cash at bank and in hand 26 30

Short-term deposits 26 149

52 179

Short-term deposits are highly liquid investments with an original maturity of three months or less, in various currencies.

19 TRADE AND OTHER PAYABLES

2007 2006

£m £m

Current

Trade payables 49 47

Other tax and social security payable 19 26

Other payables 172 190

Accruals 148 139

Derivatives 2–

390 402

Non-current

Other payables 139 109

Trade payables are non-interest bearing and are normally settled within 45 days.

Other payables include £212m (2006 £180m) relating to the future redemption liability of the Group’s loyalty programme, of which

£84m (2006 £83m) is classified as current and £128m (2006 £97m) as non-current.

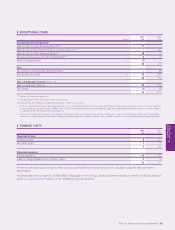

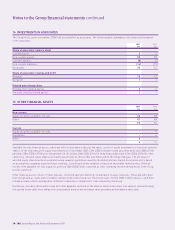

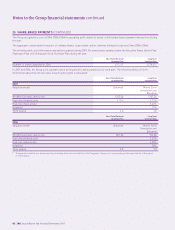

20 LOANS AND OTHER BORROWINGS

2007 2006

Current Non-current Total Current Non-current Total

£m £m £m £m £m £m

Secured bank loans –33437

Finance leases 8 92 100 39497

Unsecured bank loans – 774 774 3 206 209

Total borrowings 8 869 877 10 303 313

Denominated in the following currencies:

Pounds sterling – 275 275 – 102 102

US dollars 8 425 433 10 145 155

Euro – 121 121 –5454

Other –4848 –22

8 869 877 10 303 313