Holiday Inn 2007 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22 IHG Annual Report and Financial Statements 2007

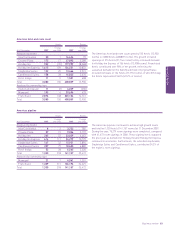

Business review continued

Risk management

The Group is subject to a variety of risks which could have a

negative impact on its performance and financial condition. The

Board is responsible for the Group’s system of internal control

and risk management, and for reviewing its effectiveness. In order

to discharge that responsibility, the Board has established an

ongoing process to identify significant business risks facing the

Group. The Board also receives assurance from the internal

audit and risk management functions that these risks are being

appropriately managed, having regard to the balance of risk,

cost and opportunity.

This section describes some of the risks that could materially

affect the Group’s business. The factors below should be considered

in connection with any financial and forward-looking information

in this Business Review and the cautionary statements contained

on page 101.

The risks below are not the only ones that the Group faces.

Some risks are not yet known to IHG and some that IHG does not

currently believe to be material could later turn out to be material.

All of these risks could materially affect the Group’s business,

revenue, operating profit, earnings, net assets and liquidity

and/or capital resources.

The Group is reliant on the reputation of its brands and the

protection of its intellectual property rights

Any event that materially damages the reputation of one or more

of the Group’s brands and/or failure to sustain the appeal of the

Group’s brands to its customers could have an adverse impact

on the value of that brand and subsequent revenues from that

brand or business. In addition, the value of the Group’s brands is

influenced by a number of other factors, some of which may be

outside the Group’s control, including commoditisation (whereby

price/quality becomes relatively more important than brand

identifications due, in part, to the increased prevalence of third-

party intermediaries), consumer preference and perception,

failure by the Group or its franchisees to ensure compliance

with the significant regulations applicable to hotel operations

(including fire and life safety requirements), or other factors

affecting consumers’ willingness to purchase goods and services,

including any factor which adversely affects the reputation of

those brands.

In particular, where the Group is unable to enforce adherence to

its operating and quality standards, or the significant regulations

applicable to hotel operations, pursuant to its management and

franchise contracts, there may be further adverse impact upon

brand reputation or customer perception and therefore the value

of the hotel brands.

Given the importance of brand recognition to the Group’s

business, the Group has invested considerable effort in protecting

its intellectual property, including registration of trademarks and

domain names. However, the laws of certain foreign countries in

which the Group operates do not protect the Group’s proprietary

rights to the same extent as the laws in the US and the European

Union. This is particularly relevant in China where, despite recent

improvements in intellectual property rights, the relative lack

of protection increases the risk that the Group will be unable

to prevent infringements of its intellectual property in this key

growth market. Any widespread infringement or misappropriation

could materially harm the value of the Group’s brands and its

ability to develop the business.

The Group is exposed to a variety of risks related to identifying,

securing and retaining management and franchise agreements

The Group’s growth strategy depends on its success in identifying,

securing and retaining management and franchise agreements.

Competition with other hotel companies may generally reduce

the number of suitable management, franchise and investment

opportunities offered to the Group and increase the bargaining

power of property owners seeking to engage a manager or

become a franchisee. The terms of new management or franchise

agreements may not be as favourable as current arrangements

and the Group may not be able to renew existing arrangements

on the same terms.

There can also be no assurance that the Group will be able to

identify, retain or add franchisees to the Group system or to

secure management contracts. For example, the availability

of suitable sites, planning and other local regulations or the

availability and affordability of finance may all restrict the supply

of suitable hotel development opportunities under franchise or

management agreements. There are also risks that significant

franchisees or groups of franchisees may have interests that

conflict, or are not aligned, with those of the Group including,

for example, the unwillingness of franchisees to support brand

improvement initiatives. In connection with entering into

management or franchise agreements, the Group may be

required to make investments in, or guarantee the obligations

of, third-parties or guarantee minimum income to third-parties.

Changes in legislation or regulatory changes may be

implemented that have the effect of favouring franchisees relative

to brand owners.

The Group is exposed to the risks of political and economic

developments

The Group is exposed to the risks of global and regional adverse

political, economic and financial market developments, including

recession, inflation and currency fluctuations that could lower

revenues and reduce income. A recession in one country or more

widely tends to reduce leisure and business travel to and from

affected countries and would adversely affect room rates and/or

occupancy levels and other income-generating activities resulting

in deterioration of results of operations and potentially reducing

the value of properties in affected economies. The owners or

potential owners of hotels managed or franchised by one group

face similar risks which could adversely affect IHG’s ability to

secure management or franchise agreements. More specifically,

the Group is highly exposed to the US market and, accordingly, is

particularly susceptible to adverse changes in the US economy.