Holiday Inn 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PARENT COMPANY

FINANCIAL STATEMENTS

Parent company balance sheet and Notes to the parent company financial statements 93

Notes to the parent company financial statements

1 ACCOUNTING POLICIES

Basis of accounting

The financial statements are prepared under the historical cost convention. They have been drawn up to comply with applicable

accounting standards in the United Kingdom (UK GAAP). These accounts are for the Company and are not consolidated financial

statements.

Fixed asset investments

Fixed asset investments are stated at cost less any provision for impairment.

Bank and other borrowings

Bank and other borrowings are initially recognised at the fair value of the consideration received less directly attributable transaction

costs. Finance costs are charged to the profit and loss account using the effective interest rate method.

Borrowings are classified as due after more than one year when the repayment date is more than 12 months from the balance sheet

date or where they are drawn on a facility with more than 12 months to expiry.

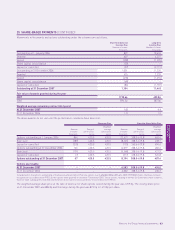

2 EMPLOYEES AND DIRECTORS

2007 2006

Average number of employees (Non-Executive Directors) 78

2007 2006

£m £m

Staff costs 11

Detailed information on the emoluments, pensions, option holdings and shareholdings for each Director is shown in the Remuneration

Report on pages 36 to 44.

3 INVESTMENTS

£m

At 1 January 2007 and 31 December 2007 2,767

The Company is the beneficial owner of all of the equity share capital of InterContinental Hotels Limited. The principal operating

subsidiary undertakings of that company are listed in note 35 of the Group financial statements.

4 DEBTORS

2007 2006

£m £m

Amounts due from subsidiary undertakings 166 8

Corporate taxation 41 21

207 29

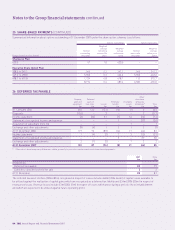

5 CREDITORS: AMOUNTS FALLING DUE WITHIN ONE YEAR

2007 2006

£m £m

Amounts due to subsidiary undertakings 2,631 1,624

6 CREDITORS: AMOUNTS FALLING DUE AFTER MORE THAN ONE YEAR

2007 2006

£m £m

Unsecured bank loan –102

The unsecured bank borrowings were drawn under a 2009 £1.1bn Syndicated Facility. Covenants exist on this facility and as at the

balance sheet date the Group and the Company were not in breach of these covenants.

PARENT COMPANY

FINANCIAL STATEMENTS