Holiday Inn 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BUSINESS REVIEW

Business review 7

Strategy

IHG’s ambition

IHG seeks to deliver enduring top quartile shareholder returns, when measured against a broad global hotel peer group.

IHG’s strategy

The Group’s underlying strategy is that by putting the guest first, IHG will grow a portfolio of differentiated hospitality brands in core

strategic countries and global key cities to maximise our scale advantage. With a clear target for room growth and a number of brands

with market premiums offering excellent returns for owners, the Group is well placed to execute the following strategic priorities:

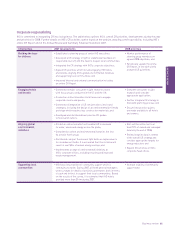

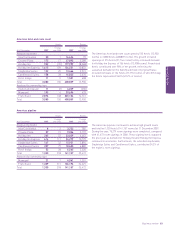

Strategic priorities Key performance indicators Current status and 2008 priorities

(KPIs) v 2006* 2007 developments

BUSINESS REVIEW

Brand performance

To operate a portfolio of brands

attractive to both owners and

guests that have clear market

positions and differentiation in

the eyes of the guest.

Excellent hotel returns

To generate higher owner

returns through revenue

delivery and improved

operating efficiency.

• Global revenue per available

room (RevPAR) growth 6.9%; and

• RevPAR growth premiums

to respective key market

segments** (% pt increase)

+ 4.4 InterContinental US

+ 1.0 Holiday Inn US

+ 0.7 Holiday Inn Express US

+ 3.5 InterContinental EMEA

+ 0.3 Holiday Inn and

Holiday Inn Express UK.

• Total gross revenue (TGR)

growth 17.1%;

• Continuing operating profit

margin growth 1.4% pts;

• Priority Club Rewards (PCR)

membership growth 17.6%;

and

• Return on capital employed

(ROCE) increased by 4% pts

to 7% for IHG’s flagship

InterContinental hotels

(New York, London Park

Lane, Paris Le Grand and

Hong Kong).

• Relaunch of Holiday Inn

brand family;

• International launch of

Staybridge Suites; and

• InterContinental positioning

continued to gain ground, with

advertising driving a material

change in consumer ‘intent

to stay’, up 10% in the year.

• Increased revenue delivery through

IHG global reservation channels by

19.3% to $6.8bn of global system

room revenue in 2007, including

$2.6bn from the internet;

• Industry leading PCR loyalty

programme with 37 million

members, contributing $5.2bn

of global system room revenue,

an increase of 16.3%; and

• Strong web presence:

holidayinn.com is the industry’s

most visited site, with around

75 million site visits per annum; new

InterContinental website launch.

• Roll-out of the Holiday Inn

brand family relaunch; and

• Define and roll-out Hotel

Indigo internationally and

continue to build scale in

the US.

• Integrate reservation channels

to provide a seamless and

differentiated experience

for guests;

• Drive more value from the

IHG loyalty programme

initiatives; and

• Implement technology

upgrades across guest insight,

owner insight and revenue

delivery systems.

Market scale and knowledge

To accelerate profitable growth

in the largest markets where

the Group currently has scale.

• Progress against 2008

growth targets, set in

June 2005:

– 47,419 net room growth;

– 81 hotels in China; and

– 13 net InterContinental

hotel additions.

• Significant progress against

2008 growth targets;

• TGR growth in US 8.5%, UK

22.4%, China 31.0%, Japan

269.9%; and

• 90% of pipeline focused on

core strategic countries.

• Achieve 2008 growth targets:

– 50,000-60,000 net room growth;

– 125 hotels in China;

– 15-25 net InterContinental

hotel additions; and

• Execute agreed strategies

for core strategic countries.

Aligned organisation

To create a more efficient

organisation with strong core

capabilities.

• 2007 employee engagement

of 65%, as defined on page 10

of this Report.

• Defined ‘core purpose’

for the organisation –

Great Hotels Guests Love;

• Continued to strengthen IHG’s

senior management team with

new regional and functional

appointments; and

• Created Winning Ways and

Room to be yourself initiatives,

as explained on page 9 of this

Report, resulting in increased

employee engagement.

• Align organisation

behind core purpose of

Great Hotels Guests Love;

and

• Increase investment in

key countries to compete

for talent.

* KPIs v 2006 unless stated otherwise. ** Source: STR, Deloitte