Holiday Inn 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 IHG Annual Report and Financial Statements 2007

Remuneration report continued

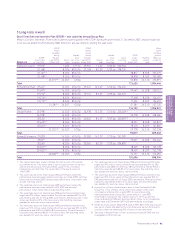

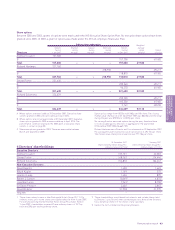

Long Term Incentive Plan (LTIP) – previously called the Performance Restricted Share Plan

In 2007, there were three cycles in operation and one cycle which vested.

The awards made in respect of cycles ending on 31 December 2006, 2007, 2008 and 2009 and the maximum pre-tax number

of ordinary shares due if performance targets are achieved in full are set out in the table below. In respect of the cycle ending on

31 December 2007, the Company finished in fourth place in the TSR group and achieved a relative cumulative annual rooms growth

(CAGR) of 3.1%. Accordingly, 55.3% of the award will vest on 20 February 2008.

Maximum Maximum Expected

LTIP LTIP value value

shares shares based based

Maximum awarded vested on share on share

LTIP during Market during Market Actual/ Maximum price of price of

shares the year price per the year price per Value at planned LTIP shares 884.0p at 884.0p at

held at 1 Jan 2007 to Award share at 1 Jan 2007 to share at vesting vesting held at 31 Dec 2007 31 Dec 2007

Directors 1 Jan 2007 31 Dec 2007 date award 31 Dec 2007 vesting £ date 31 Dec 2007 £ £

Andrew Cosslett 136,43211.4.05 617.5p 85,133 1249p 1,063,311 21.2.07 –

276,200229.6.05 706p – 20.2.08 276,200 2,441,608 1,350,0108

200,74033.4.06 941.5p – 18.2.09 200,740 1,774,542

159,50642.4.07 1256p – 17.2.10 159,506 1,410,034

Total 636,446 5,626,184

Richard Hartman 165,130124.6.04 549.5p 103,041 1249p 1,286,982 21.2.07 –

214,870229.6.05 706p – 20.2.08 196,96451,741,162 962,8638

146,11033.4.06 941.5p – 18.2.09 85,2305753,434

113,73142.4.07 1256p – 17.2.10 28,4325251,339

Total 310,626 2,745,935

Stevan Porter 142,290124.6.04 549.5p 88,788 1249p 1,108,962621.2.07 –

174,900229.6.05 706p – 20.2.08 174,900 1,546,116 855,0038

132,24033.4.06 941.5p – 18.2.09 132,240 1,169,002

92,66742.4.07 1256p – 17.2.10 92,667 819,177

Total 399,807 3,534,295

Richard Solomons 144,990124.6.04 549.5p 90,473 1249p 1,130,008 21.2.07 –

176,550229.6.05 706p – 20.2.08 176,550 1,560,702 863,0698

128,47033.4.06 941.5p – 18.2.09 128,470 1,135,675

102,10942.4.07 1256p – 17.2.10 102,109 902,644

Total 407,129 3,599,021

Former Directors

Richard North 144,9931,7 24.6.04 549.5p 90,475 1249p 1,130,033 21.2.07 –

Total –

1 This award was based on performance to 31 December 2006 where the

performance measure related to both the Company's TSR against a group

of eight other comparator companies and growth in return on capital

employed (ROCE). The number of shares released was graded, according to

a) where the Company finished in the TSR comparator group, with 50% of

the award being released for first or second position and 10% of the award

being released for fifth place; and b) growth in ROCE, with 50% of the

award being released for 141.6% growth and 10% of the award being

released for 70% growth. The Company finished in third place in the TSR

group and achieved ROCE growth of 98.2%. Accordingly, 62.4% of the award

vested on 21 February 2007.

2 This award is based on performance to 31 December 2007 where the

performance measure relates to both the Company’s TSR against a group

of seven other comparator companies and the cumulative annual growth

rate (CAGR) of rooms in the IHG system relative to a group of five other

comparator companies. The number of shares released is graded,

according to a) where the Company finished in the TSR comparator group,

with 50% of the award being released for first or second position and 10%

of the award being released for median position; and b) relative CAGR with

50% of the award being released for 3.4% (upper quartile) CAGR and 10%

of the award being released for 2.4% (median) CAGR.

3 This award is based on performance to 31 December 2008 where the

performance measure relates to both the Company’s TSR against a group

of eight other comparator companies and the relative CAGR of rooms in

the IHG system.

4 This award is based on performance to 31 December 2009 where the

performance measure relates to both the Company's TSR against a group

of eight other comparator companies and the compound annual growth

rate in earnings per share (EPS) over the performance period.

5 Richard Hartman’s awards were pro-rated to reflect his contractual service

during the applicable performance periods.

6 The value of Stevan Porter’s shares at vesting includes £129,378 that was

chargeable to UK income tax.

7 Richard North’s award was pro-rated to reflect his contractual service

during the applicable performance period.

8 The Company finished in fourth place in the TSR group and achieved CAGR

of 3.1%. Accordingly, 55.3% of the award will vest on 20 February 2008.