Holiday Inn 2007 Annual Report Download - page 40

Download and view the complete annual report

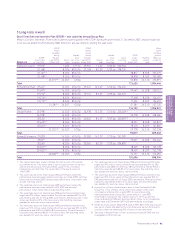

Please find page 40 of the 2007 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Awards under the Annual Bonus Plan will be linked to individual

performance (30% of total award), EBIT (50% of total award)

and net annual rooms additions (20% of total award). Individual

performance is measured by the achievement of specific

Key Performance Objectives that are linked directly to the

Group’s strategic priorities, and an assessment of performance

against leadership competencies and behaviours.

Under the financial measure (EBIT), threshold payout is 90%

of target performance, with maximum payout at 110% of target.

If performance under the financial measure in any year is below

threshold, payouts on all other measures are reduced by half.

Long Term Incentive Plan

The Long Term Incentive Plan (LTIP) was formerly called the

Performance Restricted Share Plan. It allows Executive Directors

and eligible employees to receive share awards, subject to the

satisfaction of a performance condition, set by the Committee,

which is normally measured over a three-year period. Awards

are normally made annually and, other than in exceptional

circumstances, will not exceed three times annual salary for

Executive Directors.

For the 2007/09 LTIP cycle, performance will be measured

by reference to:

• the increase in IHG’s Total Shareholder Return (TSR) over

the performance period relative to eight* identified

comparator companies: Accor, Choice, Marriott Hotels,

Millennium & Copthorne, NH Hotels, Sol Melia,

Starwood Hotels and Wyndham Worldwide; and

• growth in adjusted Earnings Per Share (EPS) over the period.

* Following the delisting of Hilton Hotels Corp. shares in October 2007.

In respect of TSR performance, 10% of the award will be released

for the achievement of median performance and 50% of the award

will be released for the achievement of first place only (previously

first or second place). In respect of EPS performance, 10% of the

award will be released if adjusted EPS growth is 10% per annum

and 50% of the award will be released if adjusted EPS growth is

20% per annum or more.

Vesting between all stated points will continue to be on

a straight-line basis. Awards under the LTIP lapse if the

performance conditions are not met – there is no retesting.

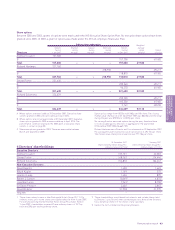

For the 2008/10 cycle, the performance measures for the LTIP

will be as follows:

• 50% of the award will be based on IHG’s TSR relative to

the Dow Jones World Hotels index. 10% of the award will be

released for the achievement of growth equal to the index and

50% of the award will be released for the out-performance of

the index by 8% per annum. Vesting between all stated points

will continue to be on a straight-line basis; and

• the other 50% of the award will depend on growth in adjusted

EPS over the period. 10% of the award will be released for

threshold performance and 50% of the award will be released

for superior performance. The Committee reviews the EPS

targets each year and, at the time of this report, the target had

not yet been determined. It will be disclosed when awards are

made in due course. In setting the target, the Committee will

take into account a range of factors, including IHG’s strategic

plans, City analysts’ expectations for IHG’s performance and

for the industry as a whole, the historical performance of the

industry and FTSE 100 market practice.

Executive share options

Since 2006, executive share options have not formed part of

the Group’s remuneration strategy. Details of prior share option

grants are given in the table on page 43.

For options granted in 2005, a performance condition has to be

met before options can be exercised. The Company’s adjusted

EPS over a three-year period must increase by at least nine

percentage points over the increase in the UK Retail Price Index

(RPI) for the same period for one-third of the options granted

to vest; 12 percentage points over the increase in RPI for the

same period for two-thirds of the options granted to vest; and

15 percentage points over the increase in RPI for the same

period for the full award to vest.

Share capital

During 2007, no awards or grants over shares were made that

would be dilutive of the Company’s ordinary share capital. Current

policy is to settle all awards or grants under any of the Company’s

share plans with shares purchased in the market, with the

exception of a number of options granted before 2005, which

are yet to be exercised and settled with the issue of new shares.

Share ownership

The Committee believes that share ownership by Executive

Directors and senior executives strengthens the link between

the individual’s personal interest and that of the shareholders.

The Executive Directors are expected to hold all shares earned

(net of any share sales required to meet personal tax liabilities)

from the Group’s remuneration plans while the value of their

holding is less than twice their base salary or three times in

the case of the Chief Executive.

2.4 Policy on external appointments

The Company recognises that its Directors may be invited to

become Non-Executive Directors of other companies and that

such duties can broaden experience and knowledge, and benefit

the business. Executive Directors are, therefore, allowed to accept

one non-executive appointment (not including positions where the

Director is appointed as the Group’s representative), subject to

Board approval, as long as this is not likely to lead to a conflict

of interest, and to retain the fees received.

Andrew Cosslett is Non-Executive Chairman of Duchy Originals

Limited, for which he receives no remuneration.

38 IHG Annual Report and Financial Statements 2007

Remuneration report continued