Harley Davidson 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

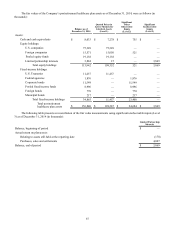

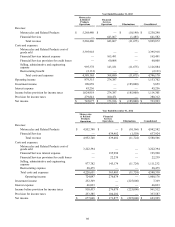

Restricted Stock Awards Settled in Stock:

Beginning in 2014, the Company granted certain eligible U.S. employees restricted stock units (RSUs) that settle in

Company stock. Prior to 2014, the Company granted restricted, nonvested, stock. The fair value of RSUs settled in stock and

restricted stock is determined based on the market price of the Company’s shares on the grant date. The following table

summarizes the RSUs settled in stock and restricted stock transactions for the year ended December€31, 2014 (in thousands

except for per share amounts):€

Restricted

Shares

Grant€Date

Fair Value

Per Share

Nonvested, beginning of period 982 $47

Granted 459 $62

Vested (464) $ 46

Forfeited (57) $ 56

Nonvested, end of period 920 $54

As of December€31, 2014, there was $21.7 million of unrecognized compensation cost related to RSUs settled in stock

and restricted stock that is expected to be recognized over a weighted-average period of 1.8 years.

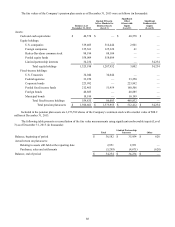

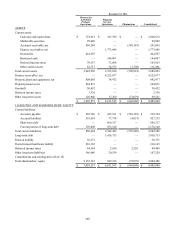

Restricted Stock Awards Settled in Cash

Restricted stock units, granted to certain eligible non-U.S. employees (RSUIs) vest under the same terms and conditions

as RSUs settled in stock and restricted stock; however, they are settled in cash equal to their settlement date fair value. As a

result, RSUIs are recorded in the Company’s consolidated balance sheets as a liability until the date of vesting.

The fair value of RSUIs is determined based on the market price of the Company’s shares on the grant date. The

following table summarizes the RSUI transactions for the year ended December€31, 2014 (in thousands except for per share

amounts):€

Restricted

Stock€Unit

Weighted-Average

Grant Date

Fair Value

Per Share

Nonvested, beginning of period 147 $66

Granted 72 $66

Vested (74) $ 63

Forfeited (16) $ 66

Nonvested, end of period 129 $66

94

18.€€€€Earnings Per Share

The following table sets forth the computation of basic and diluted earnings per share from continuing operations for the

years ended December€31 (in thousands except per share amounts):€

2014 2013 2012

Numerator:

Income used in computing basic and diluted earnings per share $844,611 $733,993 $623,925

Denominator:

Denominator for basic earnings per share-weighted-average

common shares 216,305 222,475 227,119

Effect of dilutive securities – employee stock compensation plan 1,401 1,596 2,110

Denominator for diluted earnings per share- adjusted weighted-

average shares outstanding 217,706 224,071 229,229

Earnings per common share:

Basic $3.90 $3.30 $2.75

Diluted $3.88 $3.28 $2.72