Harley Davidson 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

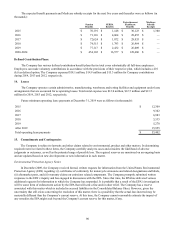

York Environmental Matters:

The Company is involved with government agencies and groups of potentially responsible parties in various

environmental matters, including a matter involving the cleanup of soil and groundwater contamination at its York,

Pennsylvania facility. The York facility was formerly used by the U.S. Navy and AMF prior to the purchase of the York facility

by the Company from AMF in 1981. Although the Company is not certain as to the full extent of the environmental

contamination at the York facility, it has been working with the Pennsylvania Department of Environmental Protection

(PADEP) since 1986 in undertaking environmental investigation and remediation activities, including an ongoing site-wide

remedial investigation/feasibility study (RI/FS). In January 1995, the Company entered into a settlement agreement (the

Agreement) with the Navy, and the parties amended the Agreement in 2013 to address ordnance and explosive waste.

The Agreement calls for the Navy and the Company to contribute amounts into a trust equal to 53% and 47%,

respectively, of future costs associated with environmental investigation and remediation activities at the York facility

(Response Costs). The trust administers the payment of the Response Costs incurred at the York facility as covered by the

Agreement.

The Company has a reserve for its estimate of its share of the future Response Costs at the York facility which is included

in accrued liabilities in the Condensed Consolidated Balance Sheets.(1) As noted above, the RI/FS is still underway and given

the uncertainty that exists concerning the nature and scope of additional environmental investigation and remediation that may

ultimately be required under the RI/FS or otherwise at the York facility, the Company is unable to make a reasonable estimate

of those additional costs, if any, that may result.

The estimate of the Company’s future Response Costs that will be incurred at the York facility is based on reports of

independent environmental consultants retained by the Company, the actual costs incurred to date and the estimated costs to

complete the necessary investigation and remediation activities. Response Costs are expected to be paid primarily over a period

of several years ending in 2017 although certain Response Costs may continue for some time beyond 2017.

Product Liability Matters:

The Company is involved in product liability suits related to the operation of its business. The Company accrues for claim

exposures that are probable of occurrence and can be reasonably estimated. The Company also maintains insurance coverage

for product liability exposures. The Company believes that its accruals and insurance coverage are adequate and that product

liability suits will not have a material adverse effect on the Company’s consolidated financial statements.

91

16. €€€€Capital Stock

Common Stock:

The Company is authorized to issue 800,000,000 shares of common stock of $0.01 par value. There were 211.9 million

and 220.0 million common shares outstanding as of December€31, 2014 and 2013, respectively.

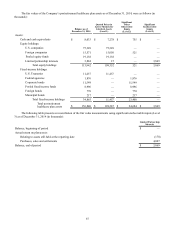

During 2014, the Company repurchased 9.3 million shares of its common stock at a weighted-average price of $66. This

includes 0.2 million shares of common stock that were repurchased from employees that surrendered stock to satisfy

withholding taxes in connection with the vesting of restricted stock awards. The remaining repurchases were made pursuant to

the following authorizations (in millions of shares):€

Shares€Repurchased Authorization€Remaining

at December€31, 2014

Board of Directors’ Authorization 2014 2013 2012

1997 Authorization 3.2 — 4.3 —

2007 Authorization 5.8 7.7 2.2 0.9

2014 Authorization — — — 20.0

Total 9.0 7.7 6.5 20.9

1997 Authorization – The Company has an authorization from its Board of Directors (originally adopted December 1997)

to repurchase shares of its outstanding common stock under which the cumulative number of shares repurchased, at the time of

any repurchase, shall not exceed the sum of (1)€the number of shares issued in connection with the exercise of stock options

occurring on or after January€1, 2004, plus (2)€1% of the issued and outstanding common stock of the Company on January€1 of

the current year, adjusted for any stock split.

2007 Authorization – In December 2007, the Company’s Board of Directors separately authorized the Company to buy

back up to 20.0 million shares of its common stock with no dollar limit or expiration date.