Harley Davidson 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

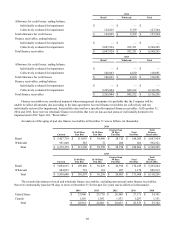

Company utilizes loss forecast models which consider a variety of factors including, but not limited to, historical loss trends,

origination or vintage analysis, known and inherent risks in the portfolio, the value of the underlying collateral, recovery rates

and current economic conditions including items such as unemployment rates. Retail finance receivables are not evaluated

individually for impairment prior to charge-off and therefore are not reported as impaired loans.

The wholesale portfolio is primarily composed of large balance, non-homogeneous loans. The Company’s wholesale

allowance evaluation is first based on a loan-by-loan review. A specific allowance for credit losses is established for wholesale

finance receivables determined to be individually impaired when management concludes that the borrower will not be able to

make full payment of contractual amounts due based on the original terms of the loan agreement. The impairment is determined

based on the cash that the Company expects to receive discounted at the loan’s original interest rate or the fair value of the

collateral, if the loan is collateral-dependent. In establishing the allowance, management considers a number of factors

including the specific borrower’s financial performance as well as ability to repay. As described below in the Financial Services

Revenue Recognition policy, the accrual of interest on such finance receivables is discontinued when the collection of the

account becomes doubtful. While a finance receivable is considered impaired, all cash received is applied to principal or

interest as appropriate.

Finance receivables in the wholesale portfolio that are not individually evaluated for impairment are segregated, based on

similar risk characteristics, according to the Company’s internal risk rating system and collectively evaluated for impairment.

The related allowance is based on factors such as the Company’s past loan loss experience, current economic conditions as well

as the value of the underlying collateral.

Impaired finance receivables also include loans that have been modified in troubled debt restructurings as a concession to

borrowers experiencing financial difficulty. Generally, it is the Company’s policy not to change the terms and conditions of

finance receivables. However, to minimize the economic loss, the Company may modify certain impaired finance receivables

in troubled debt restructurings. Total restructured finance receivables are not significant.

Repossessed inventory representing recovered collateral on impaired finance receivables is recorded at the lower of cost

or net realizable value. In the period during which the collateral is repossessed, the related finance receivable is adjusted to the

fair value of the collateral through a charge to the allowance for credit losses and reclassified to repossessed inventory.

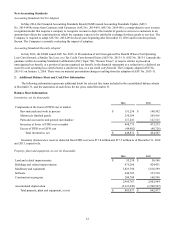

Repossessed inventory is included in other current assets and was $13.4 million and $13.8 million at December€31, 2014 and

2013, respectively.

Asset-Backed Financing – The Company participates in asset-backed financing both through term asset-backed

securitization transactions and through asset-backed commercial paper conduit facilities. The Company treats these transactions

as secured borrowing because either they are transferred to consolidated VIEs or the Company maintains effective control over

the assets and does not meet the accounting sale requirements under ASC Topic 860, "Transfers and Servicing." In the

Company's asset-backed financing programs, the Company transfers retail motorcycle finance receivables to special purpose

entities (SPE), which are considered VIEs under U.S. GAAP. Each SPE then converts those assets into cash, through the

issuance of debt.

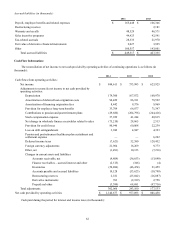

The Company is required to consolidate any VIEs in which it is deemed to be the primary beneficiary through having

power over the significant activities of the entity and having an obligation to absorb losses or the right to receive benefits from

the VIE which are potentially significant to the VIE. The Company is considered to have the power over the significant

activities of its term asset-backed securitization and asset-backed U.S. commercial paper conduit facility VIEs due to its role as

servicer. Servicing fees are typically not considered potentially significant variable interests in a VIE. However, the Company

retains a residual interest in the VIEs in the form of a debt security, which gives the Company the right to receive benefits that

could be potentially significant to the VIE. Therefore, the Company is the primary beneficiary and consolidates all of these

VIEs within its consolidated financial statements.

The Company is not the primary beneficiary of the asset-backed Canadian commercial paper conduit facility VIE;

therefore, the Company does not consolidate the VIE. However, the Company treats the conduit facility as a secured borrowing

as it maintains effective control over the assets transferred to the VIE and therefore does not meet the requirements for sale

accounting under ASC Topic 860. As such, the Company retains the transferred assets and the related debt within its

Consolidated Balance Sheet.

Servicing fees paid by VIEs to the Company are eliminated in consolidation and therefore are not recorded on a

consolidated basis. The Company is not required, and does not currently intend, to provide any additional financial support to

its VIEs. Investors and creditors only have recourse to the assets held by the VIEs.

58