Harley Davidson 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

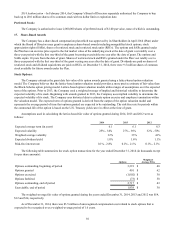

Unrecognized gains and losses related to plan obligations and assets are initially recorded in other comprehensive income

and result from actual experience that differs from assumed or expected results, and the impacts of changes in assumptions.

Unrecognized plan asset gains and losses not yet reflected in the market-related value of plan assets are not subject to

amortization. Remaining unrecognized gains and losses that exceed 10% of the greater of the projected benefit obligation or the

market-related value of plan assets are amortized to earnings over the estimated future service period of active plan

participants.€The impacts of plan amendments, if any, are amortized over the estimated future service period of plan

participants at the time of the amendment.

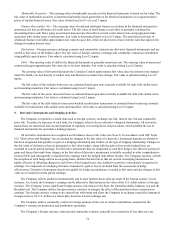

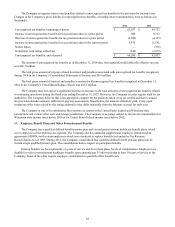

Amounts included in accumulated other comprehensive income, net of tax, at December€31, 2014 which have not yet

been recognized in net periodic benefit cost are as follows (in thousands):€

Pension€and

SERPA€Benefits

Postretirement

Healthcare€Benefits Total

Prior service cost (credit) $1,685 $(11,070) $ (9,385)

Net actuarial loss 488,080 51,108 539,188

Total $489,765 $40,038 $529,803

Amounts expected to be recognized in net periodic benefit cost, net of tax, during the year ended December€31, 2015 are

as follows (in thousands):€

Pension€and

SERPA€Benefits

Postretirement

Healthcare€Benefits Total

Prior service cost (credit) $274 $(2,025) $ (1,751)

Net actuarial loss 34,445 2,501 36,946

Total $34,719 $476 $35,195

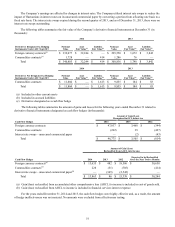

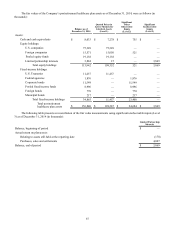

Assumptions:

Weighted-average assumptions used to determine benefit obligations and net periodic benefit cost at December€31 were

as follows:€

Pension and

SERPA Benefits

Postretirement

Healthcare Benefits

2014 2013 2012 2014 2013 2012

Assumptions for benefit obligations:

Discount rate 4.21%5.08%4.23%3.99%4.70%3.93%

Rate of compensation 4.00%4.00%4.00%n/a n/a n/a

Assumptions for net periodic benefit

cost:

Discount rate 5.08%4.23%5.30%4.70%3.93%4.90%

Expected return on plan assets 7.75%7.75%7.80%7.70%8.00%8.00%

Rate of compensation increase 4.00%4.00%3.49%n/a n/a n/a

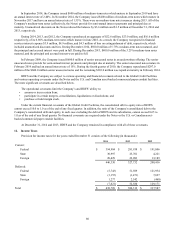

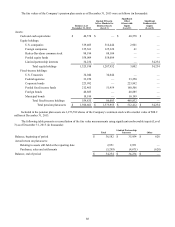

Pension and SERPA Accumulated Benefit Obligation:

The Company’s pension and SERPA plans have a separately determined accumulated benefit obligation (ABO) and plan

asset value. The ABO is the actuarial present value of benefits based on service rendered and current and past compensation

levels. This differs from the projected benefit obligation (PBO) in that it includes no assumption about future compensation

levels. The total ABO for all the Company’s pension and SERPA plans combined was $1.92 billion and $1.60 billion as of

December€31, 2014 and 2013, respectively.

84