Harley Davidson 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

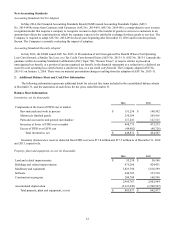

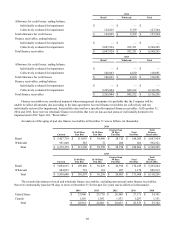

New Accounting Standards

Accounting Standards Not Yet Adopted

In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU)

No.€2014-09 Revenue from Contracts with Customers (ASU No. 2014-09). ASU No.€2014-09 is a comprehensive new revenue

recognition model that requires a company to recognize revenue to depict the transfer of goods or services to customers in an

amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. The

Company is required to adopt ASU No. 2014-09 for fiscal years beginning after December 15, 2016 and for interim periods

therein. The Company is currently evaluating the impact of adoption.

Accounting Standards Recently Adopted

In July 2013, the FASB issued ASU No.€2013-11 Presentation of an Unrecognized Tax Benefit When a Net Operating

Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists (ASU No. 2013-11). ASU No.€2013-11 amends the

guidance within Accounting Standards Codification (ASC) Topic 740, "Income Taxes", to require entities to present an

unrecognized tax benefit, or a portion of an unrecognized tax benefit, in the financial statements as a reduction to a deferred tax

asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward. The Company adopted ASU No.

2013-11 on January 1, 2014. There were no material presentation changes resulting from the adoption of ASU No. 2013-11.

61

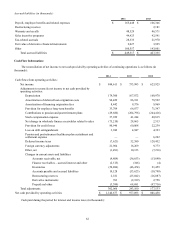

2.€€€€Additional Balance Sheet and Cash Flow Information

The following information represents additional detail for selected line items included in the consolidated balance sheets

at December€31, and the statements of cash flows for the years ended December€31.

Balance Sheet Information:

Inventories, net (in thousands):€

2014 2013

Components at the lower of FIFO cost or market

Raw materials and work in process $151,254 $140,302

Motorcycle finished goods 230,309 205,416

Parts and accessories and general merchandise 117,210 127,515

Inventory at lower of FIFO cost or market 498,773 473,233

Excess of FIFO over LIFO cost (49,902)(48,726)

Total inventories, net $448,871 $424,507

Inventory obsolescence reserves deducted from FIFO cost were $17.8 million and $17.5 million as of December€31, 2014

and 2013, respectively.

Property, plant and equipment, at cost (in thousands):€

2014 2013

Land and related improvements $55,238 $56,146

Buildings and related improvements 475,268 424,431

Machinery and equipment 1,823,790 1,816,599

Software 440,703 337,210

Construction in progress 200,708 168,598

2,995,707 2,802,984

Accumulated depreciation (2,112,630)(1,960,507)

Total property, plant and equipment, at cost $883,077 $842,477