Harley Davidson 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

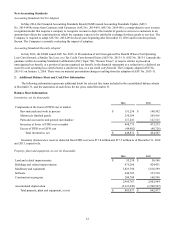

A significant part of managing the Company's finance receivable portfolios includes the assessment of credit risk

associated with each borrower. As the credit risk varies between the retail and wholesale portfolios, the Company utilizes

different credit risk indicators for each portfolio.

The Company manages retail credit risk through its credit approval policy and ongoing collection efforts. The Company

uses FICO scores, a standard credit rating measurement, to differentiate the expected default rates of retail credit applicants

enabling the Company to better evaluate credit applicants for approval and to tailor pricing according to this assessment. Retail

loans with a FICO score of 640 or above at origination are considered prime, and loans with a FICO score below 640 are

considered sub-prime. These credit quality indicators are determined at the time of loan origination and are not updated

subsequent to the loan origination date.

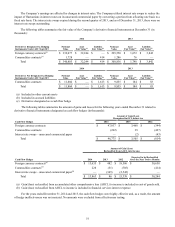

The recorded investment of retail finance receivables, by credit quality indicator, at December€31 was as follows (in

thousands):€

2014 2013

Prime $4,435,352 $4,141,559

Sub-prime 1,172,572 1,123,485

Total $5,607,924 $5,265,044

The Company's credit risk on the wholesale portfolio is different from that of the retail portfolio. Whereas the retail

portfolio represents a relatively homogeneous pool of retail finance receivables that exhibit more consistent loss patterns, the

wholesale portfolio exposures are less consistent. The Company utilizes an internal credit risk rating system to manage credit

risk exposure consistently across wholesale borrowers and individually evaluates credit risk factors for each borrower. The

Company uses the following internal credit quality indicators, based on an internal risk rating system, listed from highest level

of risk to lowest level of risk, for the wholesale portfolio: Doubtful, Substandard, Special Mention, Medium Risk and Low

Risk. Based upon management’s review, the dealers classified in the Doubtful category are the dealers with the greatest

likelihood of being charged-off, while the dealers classified as Low Risk are least likely to be charged-off. The internal rating

system considers factors such as the specific borrower's ability to repay and the estimated value of any collateral. Dealer risk

rating classifications are reviewed and updated on a quarterly basis.

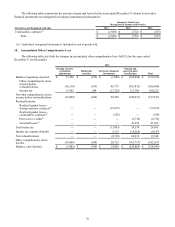

The recorded investment of wholesale finance receivables, by internal credit quality indicator, at December€31 was as

follows (in thousands):€

2014 2013

Doubtful $954 $—

Substandard 7,025 8,383

Special Mention — 2,076

Medium Risk 11,557 5,205

Low Risk 932,785 829,548

Total $952,321 $845,212

69

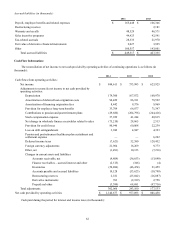

6.€€€€Asset-Backed Financing

The Company participates in asset-backed financing through both term asset-backed securitization transactions and

through asset-backed commercial paper conduit facilities. The Company treats these transactions as secured borrowings

because assets are either transferred to consolidated VIEs or the Company maintains effective control over the assets and does

not meet the accounting sale requirements under ASC Topic 860. See Note 1 for more information on the Company's

accounting for asset-backed financings and VIEs.