Harley Davidson 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

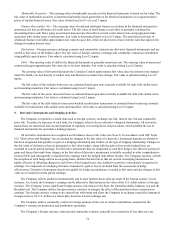

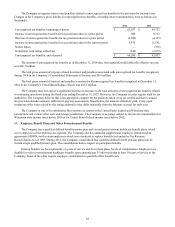

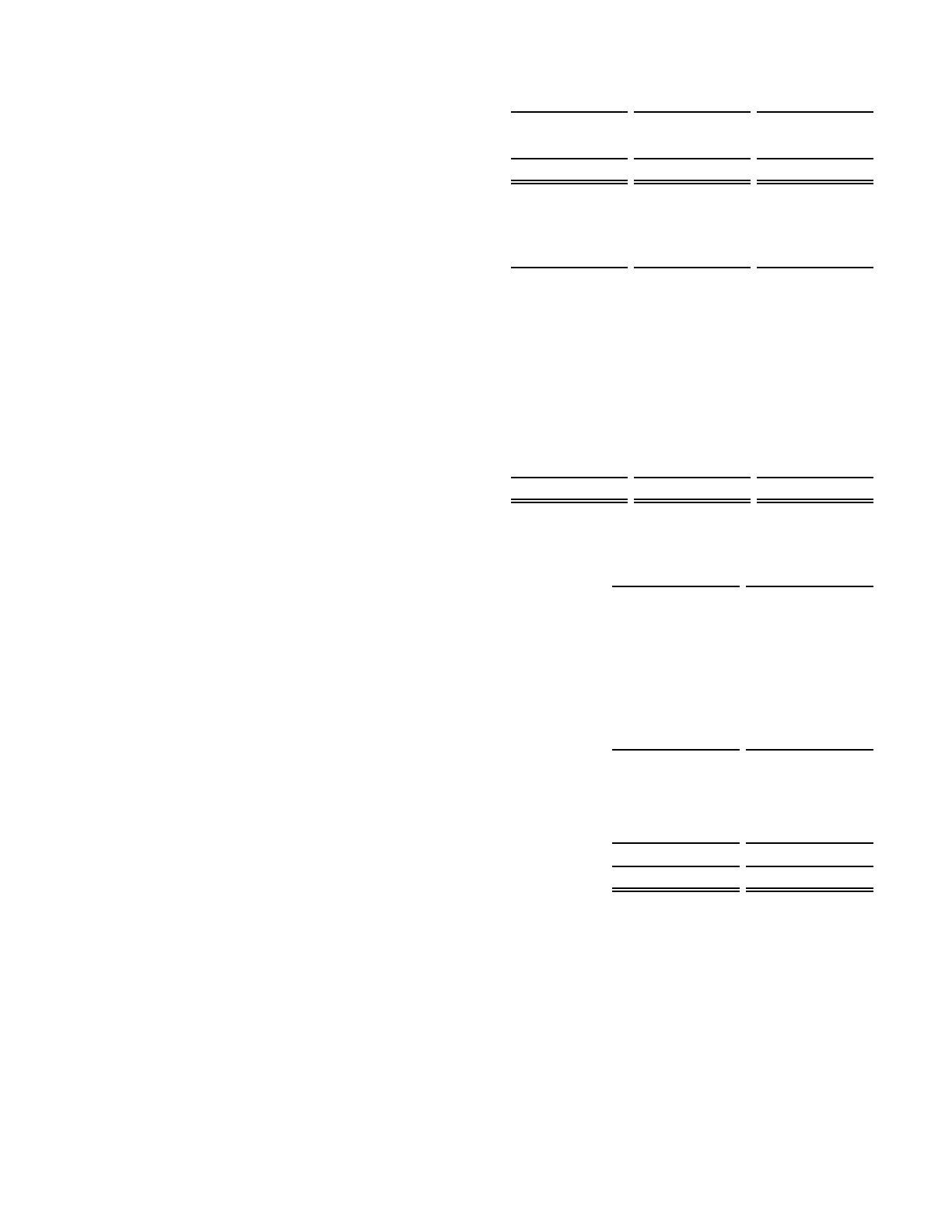

The components of income before income taxes for the years ended December€31 were as follows (in thousands):€

2014 2013 2012

Domestic $1,196,335 $1,042,317 $946,592

Foreign 86,985 71,988 14,920

Total $1,283,320 $1,114,305 $961,512

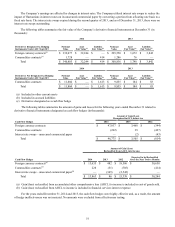

The provision for income taxes differs from the amount that would be provided by applying the statutory U.S. corporate

income tax rate due to the following items for the years ended December€31:€

2014 2013 2012

Provision at statutory rate 35.0%35.0%35.0%

State taxes, net of federal benefit 1.7 1.6 1.6

Domestic manufacturing deduction (2.1)(1.7)(1.6)

Research and development credit (0.4)(0.9)—

Unrecognized tax benefits including interest and penalties 0.2 0.9 0.1

Valuation allowance adjustments (0.1)(0.3)(0.3)

Tax audit settlements — 0.1 (0.1)

Adjustments for previously accrued taxes (0.3)(0.2)(0.4)

Other 0.2 (0.4)0.8

Provision for income taxes 34.2%34.1%35.1%

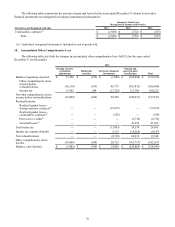

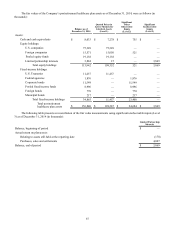

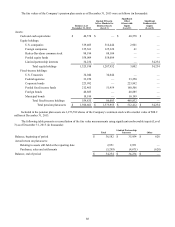

The principal components of the Company’s deferred tax assets and liabilities as of December€31 include the following

(in thousands):€

2014 2013

Deferred tax assets:

Accruals not yet tax deductible $120,817 $128,307

Pension and postretirement benefit plan obligations 104,723 5,192

Stock compensation 21,089 22,370

Net operating loss carryforward 41,927 40,530

Valuation allowance (25,462)(21,818)

Other, net 38,465 37,034

301,559 211,615

Deferred tax liabilities:

Depreciation, tax in excess of book (128,117)(119,916)

Other (5,691)(34,234)

(133,808)(154,150)

Total $167,751 $57,465

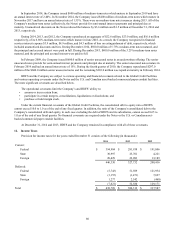

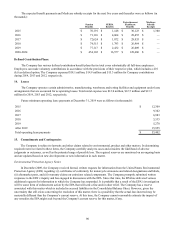

The Company reviews its deferred tax asset valuation allowances on a quarterly basis, or whenever events or changes in

circumstances indicate that a review is required. In determining the requirement for a valuation allowance, the historical and

projected financial results of the legal entity or consolidated group recording the net deferred tax asset is considered, along with

any positive or negative evidence such as tax law changes. Since future financial results and tax law may differ from previous

estimates, periodic adjustments to the Company’s valuation allowances may be necessary.

At December€31, 2014, the Company had approximately $365.0 million state net operating loss carry-forwards expiring

in 2031. At December€31, 2014 the Company also had Wisconsin research and development credit carryforwards of $13.7

million expiring in 2028. The Company had a deferred tax asset of $27.8 million as of December€31, 2014 for the benefit of

these losses and credits. A valuation allowance of $4.8 million has been established against the deferred tax asset.

The Company has foreign net operating losses (NOL) totaling $14.2 million as of December€31, 2014. It has a valuation

allowance of $20.7 million against the NOLs as well as other associated deferred tax assets.

81