Harley Davidson 2014 Annual Report Download - page 68

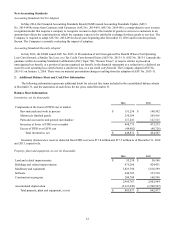

Download and view the complete annual report

Please find page 68 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

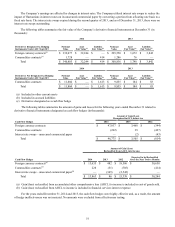

2014

Retail Wholesale Total

Allowance for credit losses, ending balance:

Individually evaluated for impairment $—$—$—

Collectively evaluated for impairment 122,025 5,339 127,364

Total allowance for credit losses $122,025 $5,339 $127,364

Finance receivables, ending balance:

Individually evaluated for impairment $—$—$—

Collectively evaluated for impairment 5,607,924 952,321 6,560,245

Total finance receivables $5,607,924 $952,321 $6,560,245

2013

Retail Wholesale Total

Allowance for credit losses, ending balance:

Individually evaluated for impairment $—$—$—

Collectively evaluated for impairment 106,063 4,630 110,693

Total allowance for credit losses $106,063 $4,630 $110,693

Finance receivables, ending balance:

Individually evaluated for impairment $—$—$—

Collectively evaluated for impairment 5,265,044 845,212 6,110,256

Total finance receivables $5,265,044 $845,212 $6,110,256

Finance receivables are considered impaired when management determines it is probable that the Company will be

unable to collect all amounts due according to the loan agreement. As retail finance receivables are collectively and not

individually reviewed for impairment, this portfolio does not have specifically impaired finance receivables. At December€31,

2014 and 2013, there were no wholesale finance receivables that were on non-accrual status or individually deemed to be

impaired under ASC Topic 310, “Receivables”.

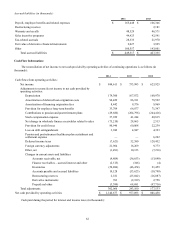

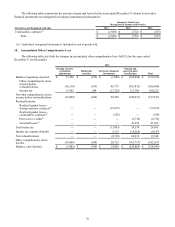

An analysis of the aging of past due finance receivables at December€31 was as follows (in thousands):€

2014

Current

31-60€Days

Past Due

61-90€Days

Past Due

Greater€than

90 Days

Past Due

Total

Past Due

Total

Finance

Receivables

Retail $5,427,719 $113,007 $38,486 $28,712 $180,205 $5,607,924

Wholesale 951,660 383 72 206 661 952,321

Total $6,379,379 $113,390 $38,558 $28,918 $180,866 $6,560,245

2013

Current

31-60€Days

Past Due

61-90€Days

Past Due

Greater€than

90 Days

Past Due

Total

Past Due

Total

Finance

Receivables

Retail $5,094,615 $109,806 $36,029 $24,594 $170,429 $5,265,044

Wholesale 844,033 791 181 207 1,179 845,212

Total $5,938,648 $110,597 $36,210 $24,801 $171,608 $6,110,256

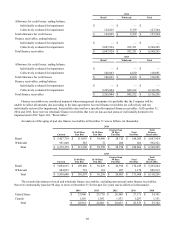

The recorded investment of retail and wholesale finance receivables, excluding non-accrual status finance receivables,

that were contractually past due 90 days or more at December€31 for the past five years was as follows (in thousands):€

2014 2013 2012 2011 2010

United States $27,800 $23,770 $26,500 $27,171 $34,391

Canada 1,118 1,031 1,533 1,207 1,351

Total $28,918 $24,801 $28,033 $28,378 $35,742

68