Harley Davidson 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

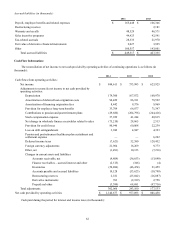

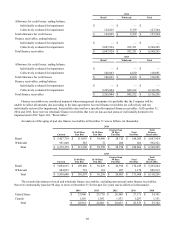

Accrued liabilities (in thousands):

2014 2013

Payroll, employee benefits and related expenses $165,448 $166,346

Restructuring reserves — 2,181

Warranty and recalls 48,529 46,571

Sales incentive programs 44,423 42,541

Tax-related accruals 28,333 21,970

Fair value of derivative financial instruments 2,027 3,925

Other 160,557 143,801

Total accrued liabilities $449,317 $427,335 €

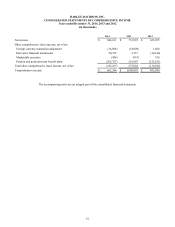

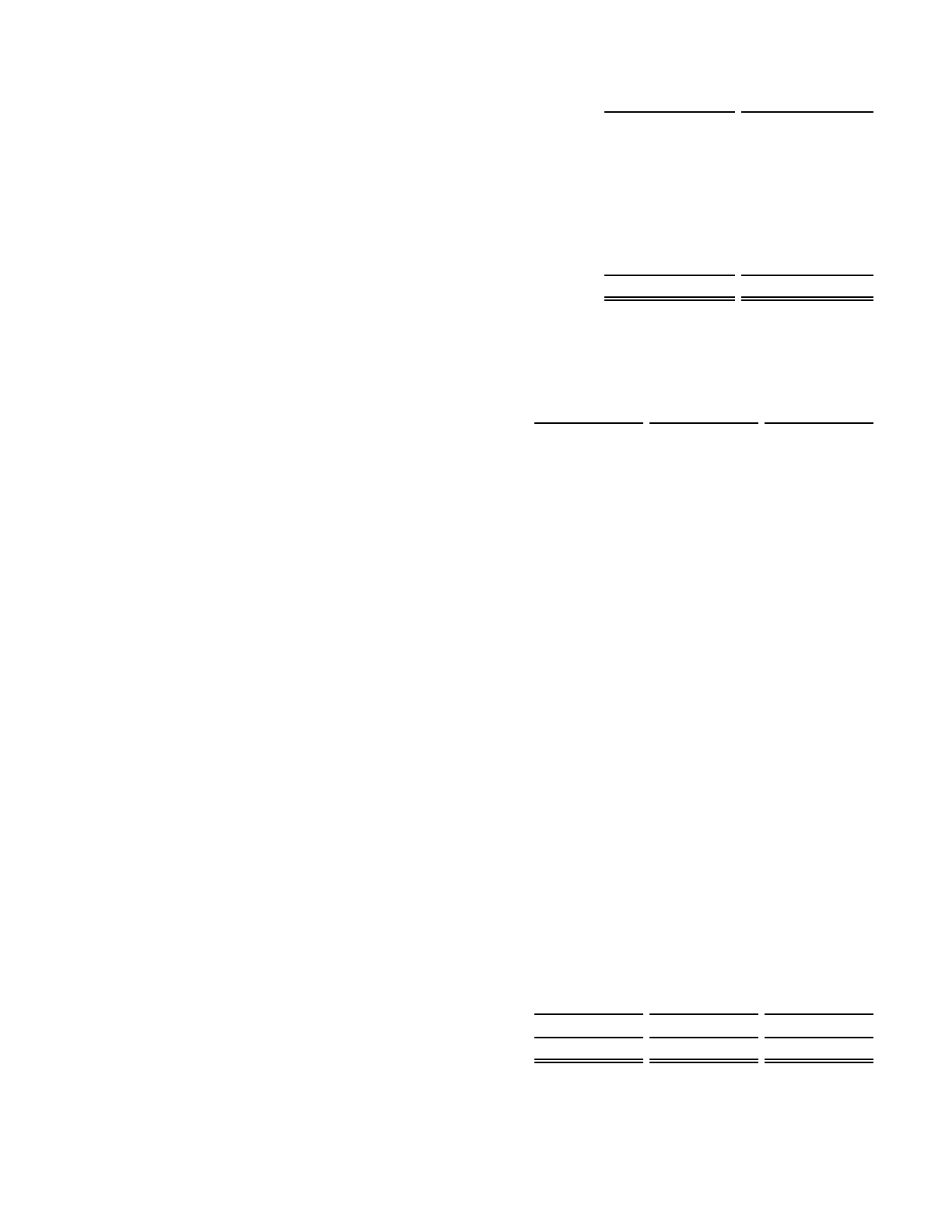

Cash Flow Information:

The reconciliation of net income to net cash provided by operating activities of continuing operations is as follows (in

thousands):

2014 2013 2012

Cash flows from operating activities:

Net income $844,611 $733,993 $623,925

Adjustments to reconcile net income to net cash provided by

operating activities:

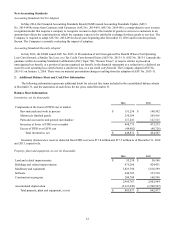

Depreciation 179,300 167,072 168,978

Amortization of deferred loan origination costs 94,429 86,181 78,592

Amortization of financing origination fees 8,442 9,376 9,969

Provision for employee long-term benefits 33,709 66,877 71,347

Contributions to pension and postretirement plans (29,686)(204,796)(244,416)

Stock compensation expense 37,929 41,244 40,815

Net change in wholesale finance receivables related to sales (75,210)28,865 2,513

Provision for credit losses 80,946 60,008 22,239

Loss on debt extinguishment 3,942 4,947 4,323

Pension and postretirement healthcare plan curtailment and

settlement expense — — 6,242

Deferred income taxes (7,621)52,580 128,452

Foreign currency adjustments 21,964 16,269 9,773

Other, net (1,491)10,123 (7,216)

Changes in current assets and liabilities:

Accounts receivable, net (9,809)(36,653)(13,690)

Finance receivables – accrued interest and other (2,515)(346)(4)

Inventories (50,886)(46,474)21,459

Accounts payable and accrued liabilities 19,128 (53,623)(10,798)

Restructuring reserves 2,181 (25,042)(16,087)

Derivative instruments 703 (2,189)2,758

Prepaid and other (3,389)68,681 (97,716)

Total adjustments 302,066 243,100 177,533

Net cash provided by operating activities $1,146,677 $977,093 $801,458

Cash paid during the period for interest and income taxes (in thousands):

62