Harley Davidson 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Cruiser (emphasizes styling and owner customization);

• Touring (emphasizes rider comfort and load capacity and incorporates features such as saddlebags, fairings, or large

luggage compartments); and

• Dual (designed with the capability for use on public roads as well as for some off-highway recreational use).

In 2014, the Company revealed Project LiveWireTM, an electric motorcycle, and began offering demonstration rides in the

U.S. which the Company plans to expand to Europe and Canada in 2015.(1) The Company is collecting the demonstration riders'

feedback to gain insight into what customers are looking for in this type of motorcycle. The Company has made no

commitment to launch Project LiveWireTM commercially.

The Company competes in the touring and cruiser categories of the motorcycle market. The touring category of the

market was pioneered by the Company and includes the Harley-Davidson Touring platform of motorcycles, including three-

wheeled motorcycles, which are generally equipped with fairings, windshields, saddlebags and/or Tour Pak® luggage carriers.

The cruiser category of the market includes motorcycles featuring the distinctive styling associated with classic Harley-

Davidson motorcycles and includes the Company’s Dyna®, Softail®, V-Rod®, Sportster® and Street motorcycle platforms.

Competition in the motorcycle markets in which the Company competes is based upon a number of factors, including

product capabilities and features, styling, price, quality, reliability, warranty, availability of financing, and quality of dealer

network. The Company believes its motorcycle products continue to generally command a premium price at retail relative to

competitors’ motorcycles. The Company emphasizes remarkable styling, customization, innovation, sound, quality, and

reliability in its products and generally offers a two-year warranty for its motorcycles. The Company promotes a

comprehensive motorcycling experience across a wide demographic range through events, rides, and rallies including those

sponsored by Harley Owners Group® (H.O.G.®). The Company considers the availability of a line of motorcycle parts and

accessories and general merchandise and the availability of financing through HDFS offered by a global network of premium

dealers as competitive advantages.

In 2014, the U.S. and European markets accounted for approximately 78% of the total annual independent dealer retail

sales of new Harley-Davidson motorcycles. The Company also competes in other markets around the world. The most

significant other markets for the Company, based on the Company's retail sales data, are Japan, Canada, Australia and Brazil.

Harley-Davidson has been the historical market share leader in the U.S. 601+cc motorcycle market. Competitors in the

U.S. 601+cc market offer motorcycles in all categories of the market including products that compete directly with the

Company's offerings in the touring and cruiser categories.

According to the Motorcycle Industry Council (MIC), the touring and cruiser categories accounted for approximately

77%, of total 2014 601+cc retail unit registrations in the U.S. while the sportbike category accounted for approximately 10% of

U.S. 601+cc motorcycle registrations. During 2014, the 601+cc portion of the market represented approximately 82% of the

total U.S. motorcycle market (street-legal models including both on-highway and dual purpose models and three-wheeled

vehicles) in terms of new units registered.

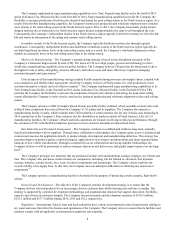

The following chart includes U.S. retail registration data for 601+cc motorcycles for the years 2012 through 2014:

U.S. Motorcycle Registration Data(a)(b)

601+cc (Units in thousands)

2014 2013 2012

Total new motorcycle registrations 313.6 305.9 299.4

Harley-Davidson new registrations 167.1 167.8 161.3

53.3%54.9%53.9%

(a) Data includes on-road 601+cc models. On-road 601+cc models include on-highway and dual purpose models and three-

wheeled vehicles.

(b) U.S. industry data is derived from information provided by Motorcycle Industry Council (MIC). This third party data is

subject to revision and update. The retail registration data for Harley-Davidson motorcycles presented in this table will

differ from the Harley-Davidson retail sales data presented in Item€7 of this report. The Company’s source for retail sales

data in Item€7 of this report is sales and warranty registrations provided by Harley-Davidson dealers as compiled by the

Company. The retail sales data in Item 7 includes sales of Street 500 motorcycles which are excluded from the 601+cc

units included in the retail registration data in this table. In addition, small differences may arise related to the timing of

data submissions to the independent sources.

4