Harley Davidson 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

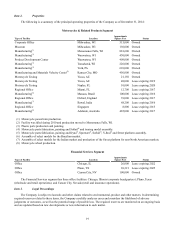

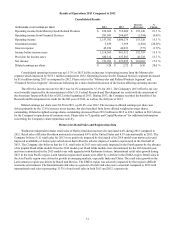

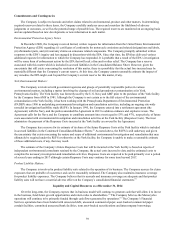

The following table includes the estimated impact of the significant factors affecting the comparability of net revenue,

cost of goods sold and gross profit from 2013 to 2014 (in millions):

Net

Revenue

Cost of

Goods

Sold

Gross

Profit

2013 $5,259 $3,397 $1,862

Volume 124 85 39

Price 166 119 47

Foreign currency exchange rates and hedging (31)(19)(12)

Shipment mix 50 (16)66

Raw material prices — 1 (1)

Manufacturing costs — (24)24

Total 309 146 163

2014 $5,568 $3,543 $2,025

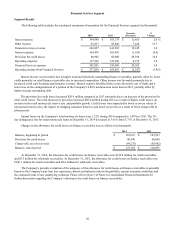

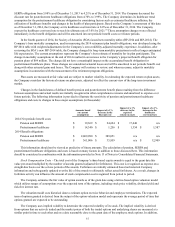

The following factors affected the comparability of net revenue, cost of goods sold and gross profit from 2013 to 2014:

• Volume increases were driven by the increase in wholesale motorcycle shipments and parts and accessories sales,

partially offset by lower sales volumes for general merchandise. General merchandise revenue was adversely impacted

in 2014 by a SKU reduction plan across the apparel offering focused on transforming the retail customer experience

with a more targeted assortment of popular styles.

• On average, wholesale prices on the Company’s 2014 and 2015 model-year motorcycles are higher than the preceding

model-year resulting in the favorable impact on revenue during the period. The revenue favorability resulting from

model-year price increases was partially offset by an increase in cost related to the significant additional content added

to the 2014 and 2015 model-year motorcycles.

• Net revenue and gross profit were negatively impacted by a devaluation in the Company's key foreign currencies

compared to the U.S. dollar, primarily the Euro, Japanese yen, Brazilian real and Australian dollar, which together

declined approximately 3% on a weighted-average basis in 2014 compared to 2013.

• Shipment mix changes between motorcycle families positively impacted net revenue and gross profit as a result of a

higher mix of Touring motorcycles which was partially offset by an increase in Street motorcycle shipments. Shipment

mix also benefited from favorable model mix within motorcycle families, as well as, favorable mix within the parts

and accessories and general merchandise product lines. For the first quarter of 2015, the Company expects mix to

adversely impact margin driven by an expected increase in Street motorcycle shipments(1).

• Raw material prices were slightly higher in 2014 relative to 2013.

• Manufacturing costs for 2014 benefited from increased year-over-year production, restructuring savings, lower

temporary inefficiencies and lower pension costs compared to 2013. The manufacturing cost benefits were partially

offset by start-up costs of approximately $15.3 million associated with the launch of the Street platform of

motorcycles.

The net increase in operating expense was primarily due to higher selling and administrative expenses and the absence of

the restructuring benefit recorded in 2013, partially offset by lower engineering expense. The higher selling and administrative

expenses were primarily due to higher spending in support of the Company's growth initiatives and higher recall costs. In 2013,

the Company completed work related to its various restructuring activities that were initiated during 2009 through 2011. For

further information regarding the Company’s previously announced restructuring activities, refer to Note 3 of Notes to

Condensed Consolidated Financial Statements.

29