Harley Davidson 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the traded options have exercise prices that are both (a)€near-the-money and (b)€close to the exercise price of the employee

stock options. Finally, the remaining maturities of the traded options on which the estimate is based are at least one year.

Dividend yield was based on the Company’s expected dividend payments and the risk-free rate was based on the U.S.

Treasury yield curve in effect at the time of grant.

Changes in the valuation assumptions could result in a significant change to the cost of an individual option. However, the

total cost of an award is also a function of the number of awards granted, and as result, the Company has the ability to control

the cost of its equity awards by adjusting the number of awards granted.

Income Taxes – The Company accounts for income taxes in accordance with ASC Topic 740, “Income Taxes.” Deferred

tax assets and liabilities are recognized for the future tax consequences attributable to differences between financial statement

carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and other loss carry-

forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the

years in which those temporary differences are expected to be recovered or settled.

The Company is subject to income taxes in the United States and numerous foreign jurisdictions. Significant judgment is

required in determining the Company’s worldwide provision for income taxes and recording the related deferred tax assets and

liabilities. In the ordinary course of the Company’s business, there are transactions and calculations where the ultimate tax

determination is uncertain. Accruals for unrecognized tax benefits are provided for in accordance with the requirements of ASC

Topic 740. An unrecognized tax benefit represents the difference between the recognition of benefits related to items for

income tax reporting purposes and financial reporting purposes. The unrecognized tax benefit is included within other long-

term liabilities in the Consolidated Balance Sheets. The Company has a reserve for interest and penalties on exposure items, if

applicable, which is recorded as a component of the overall income tax provision. The Company is regularly audited by tax

authorities as a normal course of business. Although the outcome of tax audits is always uncertain, management believes that it

has appropriate support for the positions taken on its tax returns and that its annual tax provision includes amounts sufficient to

pay any assessments. Nonetheless, the amounts ultimately paid, if any, upon resolution of the issues raised by the taxing

authorities may differ materially from the amounts accrued for each year.

38

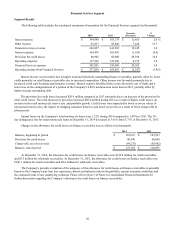

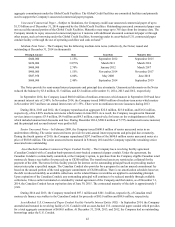

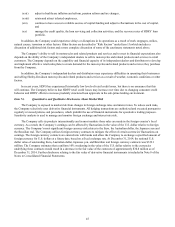

Contractual Obligations

A summary of the Company’s expected payments for significant contractual obligations as of December€31, 2014 is as

follows (in thousands):€

2015 2016 - 2017 2018 - 2019 Thereafter Total

Principal payments on debt $1,743,101 $1,881,246 $1,880,282 $—$5,504,629

Interest payments on debt 132,530 195,395 58,531 — 386,456

Operating lease payments 12,309 16,325 10,813 15,955 55,402

$1,887,940 $2,092,966 $1,949,626 $15,955 $5,946,487

Interest for floating rate instruments assumes December€31, 2014 rates remain constant.

As of December 31, 2014, the Company generally had no significant purchase obligations, other than those created in the

ordinary course of business. Purchase orders issued for inventory and supplies used in product manufacturing generally do not

become firm commitments until 90 days prior to expected delivery and can be modified to a certain extent until 30 days prior to

expected delivery.

The Company has long-term obligations related to its pension, SERPA and postretirement healthcare plans at

December€31, 2014. During 2014, the Company contributed $29.7 million to its pension, SERPA and postretirement healthcare

plans. No additional contributions were required during 2014 beyond current benefit payments for SERPA and postretirement

healthcare plans. The Company does not expect to make any additional qualified pension plan contributions in 2015.(1) Also,

the Company expects it will continue to make on-going contributions related to current benefit payments for SERPA and

postretirement healthcare plans.(1) The Company’s expected future contributions to these plans are provided in Note 13 of Notes

to Consolidated Financial Statements.

As described in Note 12 of Notes to Consolidated Financial Statements, the Company has unrecognized tax benefits of

$64.2 million and accrued interest and penalties of $25.3 million as of December€31, 2014. However, the Company cannot

make a reasonably reliable estimate for the period of cash settlement for either the liability for unrecognized tax benefits or

accrued interest and penalties.