Harley Davidson 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 Authorization – In February 2014, the Company’s Board of Directors separately authorized the Company to buy

back up to 20.0 million shares of its common stock with no dollar limit or expiration date.

Preferred Stock:

The Company is authorized to issue 2,000,000 shares of preferred stock of $1.00 par value, none of which is outstanding.

92

17.€€€€Share-Based Awards

The Company has a share-based compensation plan which was approved by its Shareholders in April 2014 (Plan) under

which the Board of Directors may grant to employees share-based awards including nonqualified stock options, stock

appreciation rights (SARs), shares of restricted stock and restricted stock units (RSUs). The options and SARs granted under

the Plan have an exercise price equal to the fair market value of the underlying stock at the date of grant vest ratably over a

three-year period with the first one-third of the grant becoming exercisable one year after the date of grant. The options and

SARs expire 10 years from the date of grant. Shares of restricted stock and RSUs granted under the Plan vest ratably over a

three-year period with the first one-third of the grant vesting one year after the date of grant. Dividends are paid on shares of

restricted stock and dividend equivalents are paid on RSUs. At December€31, 2014, there were 9.5 million shares of common

stock available for future awards under the Plan.

Stock Options:

The Company estimates the grant date fair value of its option awards granted using a lattice-based option valuation

model. The Company believes that the lattice-based option valuation model provides a more precise estimate of fair value than

the Black-Scholes option pricing model. Lattice-based option valuation models utilize ranges of assumptions over the expected

term of the options. Prior to 2013, the Company used a weighted-average of implied and historical volatility to determine the

expected volatility of its stock. Beginning with awards granted in 2013, the Company uses implied volatility to determine the

expected volatility of its stock. The Company uses historical data to estimate option exercise and employee termination within

the valuation model. The expected term of options granted is derived from the output of the option valuation model and

represents the average period of time that options granted are expected to be outstanding. The risk-free rate for periods within

the contractual life of the option is based on the U.S. Treasury yield curve in effect at the time of grant.

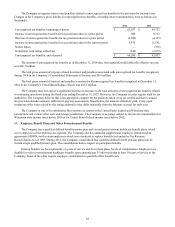

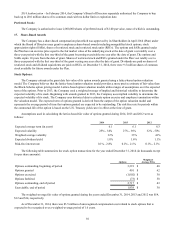

Assumptions used in calculating the lattice-based fair value of options granted during 2014, 2013 and 2012 were as

follows:€

2014 2013 2012

Expected average term (in years) 6.1 6.1 6.3

Expected volatility 25% - 34% 27% - 36% 32% - 50%

Weighted average volatility 32%33%41%

Expected dividend yield 1.8%1.6%1.1%

Risk-free interest rate 0.1% - 2.8% 0.1% - 2.1% 0.1% - 2.1%

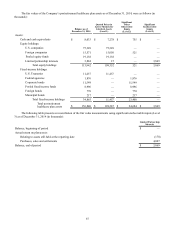

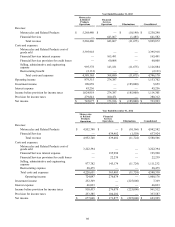

The following table summarizes the stock option transactions for the year ended December€31, 2014 (in thousands except

for per share amounts):€

Options

Weighted-

Average Price

Options outstanding, beginning of period 3,391 $40

Options granted 401 $62

Options exercised (1,002) $ 38

Options forfeited (73) $ 58

Options outstanding, end of period 2,717 $43

Exercisable, end of period 1,938 $38

The weighted-average fair value of options granted during the years ended December€31, 2014, 2013 and 2012 was $14,

$12 and $14, respectively.

As of December€31, 2014, there was $3.5 million of unrecognized compensation cost related to stock options that is

expected to be recognized over a weighted-average period of 1.6 years.