Harley Davidson 2014 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

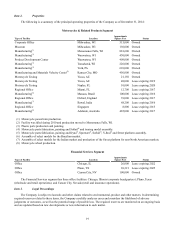

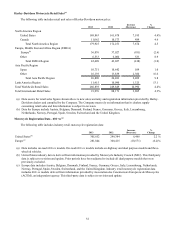

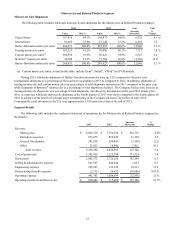

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Harley-Davidson, Inc. is the parent company for the groups of companies doing business as Harley-Davidson Motor

Company (HDMC) and Harley-Davidson Financial Services (HDFS). Unless the context otherwise requires, all references to

the "Company" includes Harley-Davidson, Inc. and all its subsidiaries. The Company operates in two business segments:

Motorcycles€& Related Products (Motorcycles) and Financial Services. The Company’s reportable segments are strategic

business units that offer different products and services and are managed separately based on the fundamental differences in

their operations.

The Motorcycles segment consists of HDMC which designs, manufactures and sells at wholesale street-legal Harley-

Davidson motorcycles as well as a line of motorcycle parts, accessories, general merchandise and related services. The

Company's products are sold to retail customers through a network of independent dealers. The Company conducts business on

a global basis, with sales in North America, Europe/Middle East/Africa (EMEA), Asia-Pacific and Latin America.

The Financial Services segment consists of HDFS which provides wholesale and retail financing and provides insurance-

related programs primarily to Harley-Davidson dealers and their retail customers. HDFS conducts business primarily in the

United States and Canada.

The “% Change” figures included in the “Results of Operations” section were calculated using unrounded dollar amounts

and may differ from calculations using the rounded dollar amounts presented.€

24

Overview

During 2014, the Company generated strong financial results as it continued to execute against its strategic goals. During

2014, the Company introduced seven new Project RushmoreTM models, including the reintroduction of Road Glide

motorcycles, began distribution of its all-new Street 750 and 500 motorcycles, and completed its implementation of flexible

surge production capabilities at its production facilities. The Company’s net income for 2014 was $844.6 million, or $3.88 per

diluted share, compared to $734.0 million, or $3.28 per diluted share, in 2013. The increase in 2014 net income was driven by

strong financial performance at the Motorcycles segment. Operating income from the Motorcycles segment was up $132.5

million over 2013 led by a 3.9% increase in wholesale shipments of Harley-Davidson motorcycles. In addition, Motorcycles

operating income benefited during 2014 from model-year price increases, a stronger product mix and lower manufacturing

costs. These positive impacts were partially offset by an adverse change in foreign currency exchange rates during 2014 and

higher selling, administrative and engineering expenses as the Company continued to invest in its strategic initiatives.

Operating income from the Financial Services segment was down slightly from the prior year, falling $5.3 million, or 1.9%,

due to a higher provision for credit losses partially offset by higher revenues.

Worldwide independent dealer retail sales of new Harley-Davidson motorcycles grew 2.7% compared to 2013 despite

challenging U.S. weather conditions in the first half of 2014 and the absence of Road Glide models for most of 2014. Retail

sales of new Harley-Davidson motorcycles increased 1.3% in the U.S. and 5.4% in international markets. As the Company

looks forward to 2015, it believes the Harley-Davidson brand and core demand fundamentals remain strong.(1) In 2015, the

Company expects continued momentum behind its model-year 2015 motorcycles including increased worldwide distribution of

its Street motorcycles.(1)

Please refer to the “Results of Operations 2014 Compared to 2013” for additional details concerning the results for 2014.

(1) Note Regarding Forward-Looking Statements

The Company intends that certain matters discussed in this report are “forward-looking statements” intended to qualify for the

safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking

statements can generally be identified as such by reference to this footnote or because the context of the statement will include

words such as the Company “believes,” “anticipates,” “expects,” “plans,” or “estimates” or words of similar meaning.

Similarly, statements that describe future plans, objectives, outlooks, targets, guidance or goals are also forward-looking

statements. Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to

differ materially from those anticipated as of the date of this report. Certain of such risks and uncertainties are described in

close proximity to such statements or elsewhere in this report, including under the caption “Risk Factors” in Item€1A and under

“Cautionary Statements” in Item€7 of this report. Shareholders, potential investors, and other readers are urged to consider these

factors in evaluating the forward-looking statements and cautioned not to place undue reliance on such forward-looking

statements. The forward-looking statements included in this report are made only as of the date of the filing of this report

(February€19, 2015), and the Company disclaims any obligation to publicly update such forward-looking statements to reflect

subsequent events or circumstances.