Harley Davidson 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

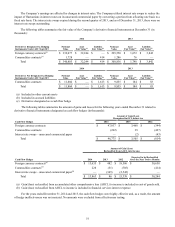

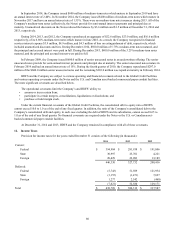

During 2014 and 2013, the Company transferred $97.1 million and $101.1 million, respectively, of Canadian retail

motorcycle finance receivables for proceeds of $85.0 million and $88.6 million, respectively. This transaction is treated as a

secured borrowing, and the transferred assets are restricted as collateral for payment of the debt.

For the years ended December€31, 2014 and 2013, the Company recorded interest expense of $3.5 million and $3.4

million, respectively, on the secured notes. Interest expense on the Canadian Conduit is included in financial services interest

expense. The weighted average interest rate of the outstanding Canadian Conduit was 2.03% at both December€31, 2014 and

2013.

As the Company participates in and does not consolidate the Canadian bank-sponsored, multi-seller conduit VIE, the

maximum exposure to loss associated with this VIE, which would only be incurred in the unlikely event that all the finance

receivables and underlying collateral have no residual value, is $27.5 million at December€31, 2014. The maximum exposure is

not an indication of the Company's expected loss exposure.

72

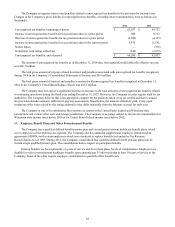

7. €€€€Fair Value Measurements

Certain assets and liabilities are recorded at fair value in the financial statements; some of these are measured on a

recurring basis while others are measured on a non-recurring basis. Assets and liabilities measured on a recurring basis are

those that are adjusted to fair value each time a financial statement is prepared. Assets and liabilities measured on a non-

recurring basis are those that are adjusted to fair value when required by particular events or circumstances. In determining the

fair value of assets and liabilities, the Company uses various valuation techniques. The availability of inputs observable in the

market varies from instrument to instrument and depends on a variety of factors including the type of instrument, whether the

instrument is actively traded, and other characteristics particular to the transaction. For many financial instruments, pricing

inputs are readily observable in the market, the valuation methodology used is widely accepted by market participants, and the

valuation does not require significant management discretion. For other financial instruments, pricing inputs are less observable

in the market and may require management judgment.

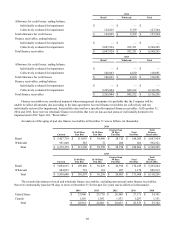

The Company assesses the inputs used to measure fair value using a three-tier hierarchy. The hierarchy indicates the

extent to which inputs used in measuring fair value are observable in the market. Level 1 inputs include quoted prices for

identical instruments and are the most observable.

Level 2 inputs include quoted prices for similar assets and observable inputs such as interest rates, foreign currency

exchange rates, commodity rates and yield curves. The Company uses the market approach to derive the fair value for its level

2 fair value measurements. Foreign currency exchange contracts are valued using publicly quoted spot and forward prices;

commodity contracts are valued using publicly quoted prices, where available, or dealer quotes; interest rate swaps are valued

using publicized swap curves; and investments in marketable securities and cash equivalents are valued using publicly quoted

prices.

Level 3 inputs are not observable in the market and include management's judgments about the assumptions market

participants would use in pricing the asset or liability. The use of observable and unobservable inputs is reflected in the

hierarchy assessment disclosed in the following tables.

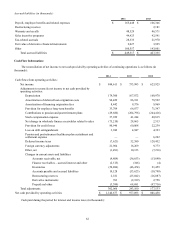

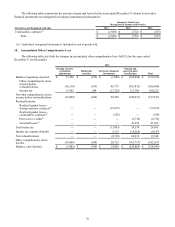

Recurring Fair Value Measurements

The following tables present information about the Company’s assets and liabilities measured at fair value on a recurring

basis as of December€31 (in thousands):

Balance as of 2014

Quoted€Prices€ in

Active€Markets€for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets:

Cash equivalents $737,024 $482,686 $254,338 $—

Marketable securities 91,140 33,815 57,325 —

Derivatives 32,244 — 32,244 —

Total $860,408 $516,501 $343,907 $—

Liabilities:

Derivatives $2,027 $—$2,027 $—